Token Burn: Creating Scarcity for cryptocurrencies

On Friday, while trying to explain a few things about HIVE to @Gabby20, I attempted to relate Hive Blockchain to a sovereign state like Nigeria and HIVE as an official currency just as we have Naira. This was in a bid to explain the market variations of HIVE prices to him when he asked of the value. In the discourse, I can remember mentioning that like every other currency (fiat), there are several activities that are meant to reduce the liquid supply of HIVE in the market so as to make it scarce and thus boost its price. One of the options I took time to explain was "staking" and I think I succeeded in giving him a basic understanding.

Asides staking tokens which come as an investment option to a HIVE user, "token burning" is another approach taken to restrict the supply of their tokens. Token burning applies to most cryptocurrencies but that of a DPoS protocol like HIVE is very interesting to learn about. I hope that my referrals and other new users would find this post quite informative.

Binance Academy defines "Coin burning" as the process of permanently removing coins from circulation, reducing the total supply. Coin Telegragh on the other hand defines token burning as an intentional action taken by the coin’s creators to “burn” — or remove from circulation — a specific number from the total available tokens in existence. Irrespective of how long or short the definition is, token burning aims at taking away some quantity of the token in the market thereby making it scarce.

The scarcity of every product has a way of making its price healthy to the favour of the producer though consumers may suffer. However, in a DPoS system like Hive blockchain, every user is a producer/stakeholder. We all co-own here by our stakes. Thus, burning HIVE and related tokens in the Hive blockchain is for the good of all its users.

While the term "burn" is used to denote the destruction of the token, no tokens are actually burnt in the process. The tokens are, however, rendered unusable in the future. There are sent to an account that only serves as a reservoir or treasury and cannot further move the token out to another account. On Hive blockchain, the treasury which collects tokens is called @null.

The interesting thing about token burn is that "it is every user's responsibility. Even a new user who has some spae tokens can decide to send his token to @Null. This applies for HIVE, HBD and other Hive tokens that are available on Hive-Engine or LeoDex

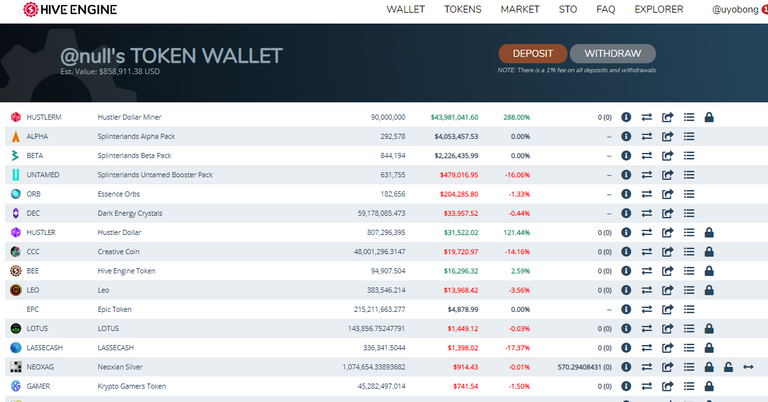

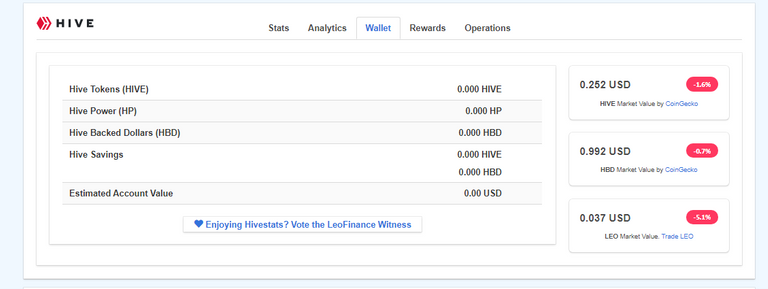

As I pen this post, @Null account has an estimated value of $859,369.70 worth of Hive tokens and several USD worth of HIVE and HBD though balances not displayed as shown in the below screenshot from Hivestats. That's quite a huge sum push into the sink by Hivers and all this is done for the health of the system and for the common good of all. Of late, community token burn plan tends to be one of the unique features that inform my investment in Hive token.

The LeoFinance BuyBack Example

LeoFinance community presently is one of the very robust community on Hive especially as a niche for finance and cryptocurrency. The community is well known for its pro-activeness in community based development and token health even in a bearish seasons as this for Hive tokens.

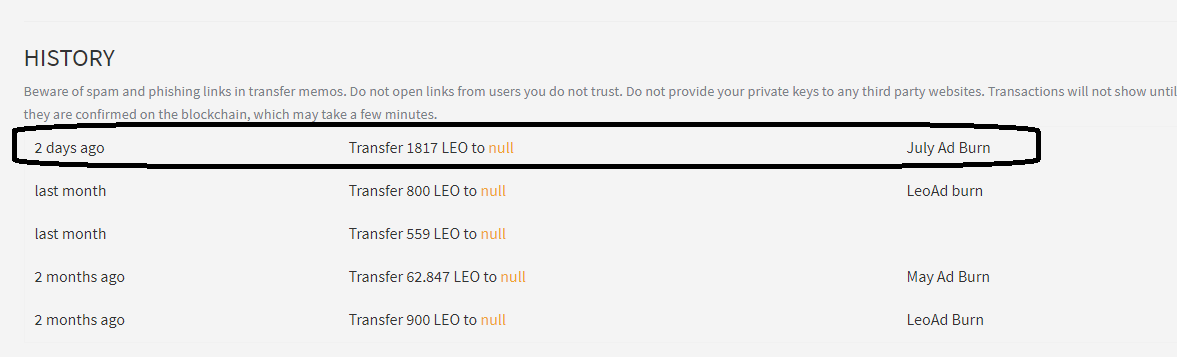

The LeoAds was created to help buy out LEO from the market and send tokens purchased to @Null. Presently, 383,546.214 has been sent to @Null which is worth about USD14,000. That's a great contribution from the community fund raised from Ads published on LeoFinance, Hivestats, LeoDex and LeoPedia.

It is crucial that every Hive user gets to the know of the essence of token burn and participate where necessary for the health of the community and token.

Posted Using LeoFinance

Nice piece, mate. I find the tokenomics behind LeoFinance's ad revenue burns really interesting.

Something that caught my attention on one of the roundtable podcasts that @khaleelkazi and the boys do, was the discussion around what happens if the ad revenue becomes high enough to start taking significant chunks of supply away and at what level does that become unhealthy for the token.

We are obviously so far away from this point that it's not an issue, but I'd like to hear further discussion around the point anyway.

Posted Using LeoFinance