The FED is turning more Hawkish. Are Cryptocurrencies going to dump?

As I was writing previously, I have been quite worried about the FED FOMC Meeting and the potential wording on tapering.

It seemed as if the FED hinted that they might raise rates in the long-run (>1year). Nothing spectacular but enought to make traders and investors worried about the upcoming inflation and the tightening on the FED balance sheet.

I believe from an economic point of view that this is the good move as we need to stop this ever-more printing money machine.

But...

It will hurt in the short term all the assets that performed very weel over the past 18 months: Tech stocks and, yes, Cryptocurrencies as investors go risk-off.

The Dollar Index is shooting higher, meaning that USD is appreciating versus a basket of other FIAT currencies. If you remember, it was this indicator that launched the Crypto Bull Market as USD was depreciating versus other currencies.

We were saying that they were printing a lot more USD, making our BTC more valuable.

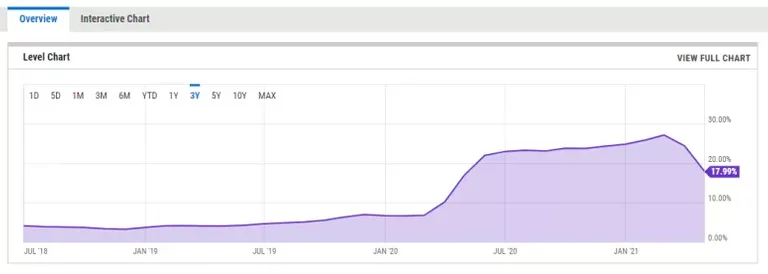

As you can see below, the FED is reducing its M2 supply creation

Not yet hawkish but clearly on the path to stop printing so much money as they understand now that there are consequences.

Cheers and Stay safe in these crazy markets !

Latest Analysis

👽RugDoc.io helps you to Ape into newly created farms on BSC or Polygon

₿itcoin Taproot Update is coming ! What is it going to change?

Posted Using LeoFinance Beta

Isn't the simple solution to balance your assets in a way where you have a healthy split between crypto and USD, so when the time comes, you can easily swivel between them with minimal friction?

Indeed ! But that is what most people are doing.

The short term volatility hurts but this increasing inflation should push Bitcoin higher in the long run in usd FIAT

Posted Using LeoFinance Beta

Hmmn...good for the USD, bad for the Nigerian naira...if the USD is going to appreciate then the naira will only depreciate further lol, it's bad enough already as it is, it'll be worse soon enough. Glad I don't hold the naira as savings

But then again will the fed be able to hold on to their word and execute as planned?

Posted Using LeoFinance Beta

Am actually surprised a Dollar to Naira is now over 400, just about a decade ago it was less than 100, the Naira have really performed badly over the years.

Posted Using LeoFinance Beta

Last year 1$=380naira

Today 1$=505naira

Just 1 year difference bro....

It's crazy, price of commodities have sky rocketed, it's crazy o

Posted Using LeoFinance Beta

Crazy stuff bro, even here in SA is the same. I just walk pass the shelves in the shops these days, the prices of things are through the roof.

Leisure spending is out of the window.

Posted Using LeoFinance Beta

I feel sorry for you guys. But inflation is rising everywhere. Even in Europe, restaurants have raised prices to catch up

Posted Using LeoFinance Beta

Sucks for people who earn in naira.

Posted Using LeoFinance Beta

This did not only affect Btc, the cryptocurrency is really suffering.

Based on the above chart bitcoin retracement is not favorable to cryptocurrency economy, I feel like this correction will not take long for Btc to break the resistance level and take a bullish trend.

Let all hope positive factors and news will happen to arise to push the market up.

For USD bullish trend to rise up to that level mean retracement will soon follow for up on it and giving btc chance to fall back up.

It’s also good to have more definitive rules versus gray areas that could sprung up like a trap down the road.

Well this view will most likely be tweaked during the next FOMC. Tighter or looser is the only question 😉

Posted Using LeoFinance Beta

It isnt happening. The Fed is not tightening anything. They simply engaged in the we might have a meeting about a meeting about tapering in a couple years. It was nothing more than to appease the rhetoric out there.

The reality is the Fed is stuck in they will be easing until the cows come home. Not that this is an exceptional thing, especially how they do it. However, that is the course they will take.

You will not see a Fed Funds rate return to "normal" ever.

Posted Using LeoFinance Beta

Yes, you are right to state that there is no tightening yet BUT this is one of the first time that they talk about lowering their expansive monetary policy in the future.

They have lowered their M2 expansion. So they are reducing the balance sheet growth compared to Pandemic levels.

Lots of words to say something so easy xD. In the end, it might be as you say to stop some rethoric that has been taking place but maybe they are serious about it considering the inflation.

Restaurants, museumes... reopened in France. Everything is 10% more expensive. They will never go back to pre-covid prices. Inflation is really here it seems.

Posted Using LeoFinance Beta

That is why the Fed will never go back. Inflation is only temporary, brought on by a supply chain shortage. Some commodities are already starting to roll over.

A belief on inflation is a disbelief of technology.

Central banks were losing the inflation battle for more than a decade, with the ECB even going negative in 2014.

And the have no idea why they are losing.

Posted Using LeoFinance Beta

The dollar is just the strength of the USD versus the rest of the currencies. So from a point of view, it seems like people would rather have dollar than things like euros. I also don't think interest rates will be going up in the long term and I think it will be transitory as I saw a few times in the news.

Posted Using LeoFinance Beta

Yup, people dumped USD because it was printed in even higher numbers than other FIAT currencies. Now that they announced that they will lower the printing rate in the future, countries, investors think it has still good value.

This is always a relative trade-off between all these FIAT currencies and national policies I guess.

Difficult to follow as they change so fast :D

Posted Using LeoFinance Beta

Possible head fake here.

Markets will throw a tantrum and the Fed with fly in and save the day with more dovishness.

If they wanted to crash the markets the perfect time to do it was 2020 when COVID could provide cover for them. They propped it up then so they'll prop it up again IMHO.

Melt up until we have runaway inflation and the plebs start to squeal about grocery prices....thats when the political pressure will be felt to rein it in.

Interesting take and I agree with you that as it has been the case for the past 14 years, FED and other central banks are there to help politicians keep their job by pumping markets (used to be independents 😉…)

But it seems inflation is already kicking in for real people so I am thinking that the music has to stop soon before the population gets louder and hyperinflation is at the corner.

I have always thought inflation was dead 💀 as Technology and other consumption has shifted the discussion. This is the first time where I can believe that « Inflation is back ».

I guess we will know more about it in a few months.

Take care

Posted Using LeoFinance Beta

Bitcoin looks like it holds up very well and I'm thinking it won't drop that much below 30,000