SteemPower Investments Club - Club Vote #0004

Hello everyone, today we will be mostly looking into possible off platform investments and voting on which you think would be best for the SPI club. We have already selected that we will use STEEM to make our investment. You can click this link to see the voting results. This time round is pretty much the same as first time with a few differences in investment options to pick from. Steemleo investment has been removed as it'll soon be self funding and will not require funding from earnings. BTC remains but maybe there should be something put in place so that the same investment cant be won more than twice in a row. The format is the same as before, all info is below just so you know. All questions please hit me up in the comments below.

Steem powered investments @spinvest has been set up to offer an investment fund based on funding from STEEM POWER. Investments are funded through extracting value out of STEEM POWER and taking advantage of STEEM's high inflation rate. The aim is not to get rich quick; the aim is to build a safe portfolio of investments that will stand the test of time while insuring all investors starting capital is not at risk. Full details can be found here

Off Platform Investments

Keeping in mind that SPI has been set up to be simple. We not after anything fancy, time consuming are fun. We are after something boring, that earn's slowing, consistently and either hedge's against inflation are compounds down on itself. As this is the first proper off platform investment chosen by members, there are 4 options to pick from below. When looking at stocks for example, there are thousands to pick from and with that in mind, i have selected only one option for each type of investment to speed to the process up a little. We are still a few weeks off the 1000 STEEM target so let's hope something good happens with the price between now and then.

Cryptocurrencies

Bitcoin won the last round of club voting and as it the only crypto that we're currently investing into off the STEEM blockchain, we gotta make sure we pick the best one which is BTC no question, ETH is good but will it be top 10 in 5 years?, im not sure. We could go for BTC again and keep loading up the celsius wallet that earning 3-4% per year. At today's price 1000 STEEM would get us around 1.6% of a Bitcoin.

Precious Metals

Silver is up again, i think gold is good but the silver to gold ratio screams to buy silver as a long term hold. The end goal would be sell silver when the ratio drops and get gold. It's basically like buying gold at a discount long term and assuming we see a ratio of around 50 silver to 1 gold, currently closer to 90 silver to 1 gold. Silver is also an excellent hedge against inflation and more importantly STEEM.

There are 2 ways to do this

1/ Buy it, hold it, own it / Buy it, store it, pay the fees

Being from the UK Mr SP Invest has to pay 20% on silver bullion so this might not be the best option. It could be done but we'll not get the silver for anywhere close to spot price and it's hard to sell. Storing it costs money and the idea of paying storage fees for a few oz's is not feasible right now with small holding. Maybe in future this could be an option as we have larger amounts to invest.

2/ Buy it, get it for spot price, dont hold it, have liquidity

We can buy and hold silver backed stocks, these are basically stocks that are pegged to silver in some currency, dollar, pound, euro, yaun, whatever. You buy them at spot and just hold them. I have seen one called the "iShares Physical Silver ETC ISLN ". I would hold these on my AJ Bell youinvest.co.uk account. I have personally been using this service for around 8 years with no problems at all so i trust to platform and management. The are also authorised and regulated by the Financial Conduct Authority.

The 2nd option might be best for us right now as we are buying small amounts. These could be saved up and converted someday into the real stuff and starting out here is just the first stepping stone to better places and larger holdings. If you'd like to club to own some silver bullion, this is your pick.

Stock and Shares

Without going through to many things and have the plan to keep it simple, a tracker fund cuts out most volatility and sort of just follows the market. Single stocks carry more risk and it would take forever to decide. A nice easy FTSE 100 tracker sounds like a nice start. This in a nutshell is a fund that invest's into the top 100 UK companies based on market cap. The yearly avg returns are 5-6% with dividends on top. As companies fall in and out of the top 100, holding are updated. There are of course different types of 100 trackers but a simple, well trusted one that pays out a dividend semi-yearly sounds right up our street. The selection would be the "HSBC FTSE 100 Index Fund Accumulation C". This is a time tested and proven 100 tracker fund. It's a boring investment but auto compounding down dividends and simply HODLing could turn something small into something big some day. These would also be hold with AJ Bell investments. If you'd like the club to dip into stocks, this is your pick

RateSetter.com (P2P lending)

This is the wild card option. Ratesetter has been around from 2010 and i have used them in the past with good experiences and still have access to my account. They provide peer to peer lending and offer lenders contracts of monthly, yearly are 5 yearly with interest rates going as term times get longer. Currently interests rates are 2.6% on rolling monthly, 3.6% on yearly and 5.3% on 5 year contracts. Please see this review, it is top result for ratesetter review and only a few weeks old from a guy that has been using them 4 years. This is be something are something like it that would be a nice addition to our portfolio, something to add to from time to time and build. 5 year contacts pay interest monthly and the there would be compounding chance there. Anyways, it's not SCS protected but has an excellent rep and i have used and trusted it in the past with no problems at all.

There are many selections that can be made and other types of investments but in the interest of keeping very simple, easy to understand and most importantly easy to track. The 4 selections above are recommendation's from Mr SP Invest based on his knowledge

SPI Club voting rules

- Confirmed SPI club members only

- 1 vote per member

- Your vote must be cast as a comment to be counted

- Voting more once will result is no vote

- Voting will last for 7 days until post payout

- Results will be edited into this post

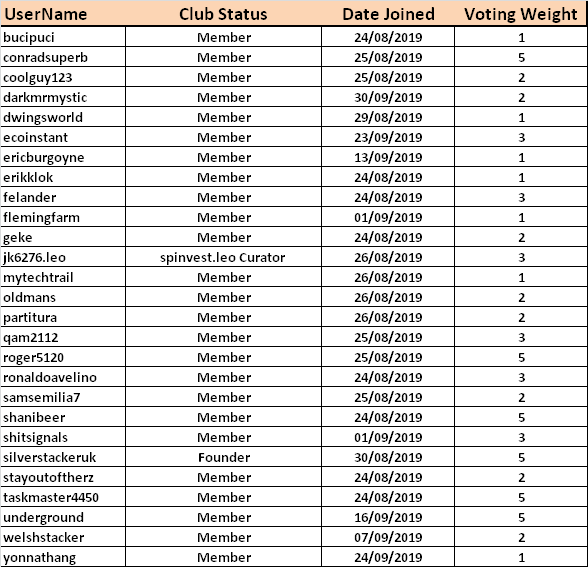

Confirmed Members

We have 4 options to vote on

- Cryptocurrencies

1000 STEEM for 0.016 BTC

- Precious Metals

1000 STEEM for 7.52oz's of silver

- Stocks and Shares

1000 STEEM for £102.77 into a FTSE 100 tracker

- P2P Lending

1000 STEEM for £102.77 into P2P lending

How to vote

In the comment below, there will be 4 comments by @spinvest. Each comment will contain the information about each selection. To cast you vote, please leave the reply "Confirmed SPI member" to your selected option. There is no need to upvote but i cant stop you. Remember, it's as easy as 1,2,3

1/ Make your mind

2/ Find your selection in the comments below

3/ Leave a reply with the wording "Confirmed SPI member" to cast your vote

Results

| Total members voted | - |

| Total voting weight used | - |

| Votes for Crypto | - |

| Votes for Silver | - |

| Votes for 100 tracker | - |

| Votes for P2P | - |

| ***********X******** | Past voting results | ********X*********** |

|---|---|---|

| #001 | #002 | #003 |

Cryptocurrencies

1000 STEEM for 0.016 BTC

Precious Metals

1000 STEEM for 7.52z's of silver

Comfirmed SPI member

Confirmed SPI member

It's time to get some Silver I think - probably option 2 being best.

Confirmed SPI member.

Posted using Partiko Android

Confirmed SPI member.

Confirmed SPI member.

Confirmed SPI member

Confirmed SPI member

Confirmed SPI member

2/ Buy it, get it for spot price, dont hold it, have liquidity

We can buy and hold silver backed stocks, these are basically stocks that are pegged to silver in some currency, dollar, pound, euro, yaun, whatever. You buy them at spot and just hold them. I have seen one called the "iShares Physical Silver ETC ISLN ".

Confirmed SPI member

Posted using Partiko iOS

Confirmed SPI member.

Posted using Partiko iOS

Stocks and Shares

1000 STEEM for £102.77 into a FTSE 100 tracker

Confirmed SPI member

P2P Lending

1000 STEEM for £102.77 into P2P lending

"Confirmed SPI member" ... I think P2P lending investment is a good place to invest. This will be option 1. Option 2 - SIlver!!! - I side this that for long term this is good now, its at a discount compared to gold price. Stocks - no. I believe, its a recession time for the economy, leave stocks and invest in crytos and metals!!!

"Confirmed SPI member"