Five Multi-Trillion Dollar Innovation Platforms | Part 1 - The Story is Already Written

Cathie Woods is the Founder & CEO of Ark Invest and is a well-known advocate of investing in disruptive technologies that she believes will have a massive impact on the future of civilization. She’s known for being a Tesla Bull, a Bitcoin advocate and much more.

I’ve listened to a few of her talks/podcast episodes and I enjoy her commentary on the tech investing landscape. She’s clearly bullish about bleeding edge technologies and she often throws out some pretty awe-striking numbers about the potential of these investments, but she also backs everything she says by data and research .

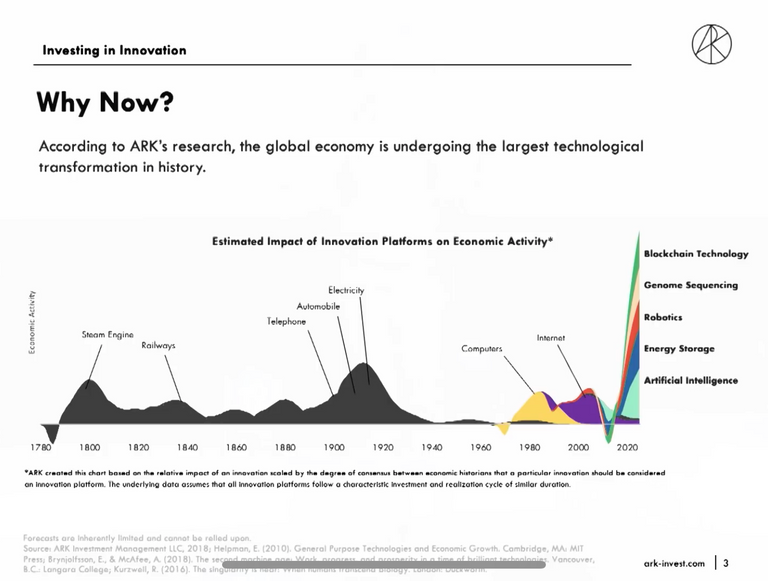

Data and research alone won’t make the whole cake, but they are essential ingredients to the finished product. In this talk she gave at a summit in South Africa, she talked extensively about the five multi-trillion dollar platforms of innovation that she and Ark Invest are focused on moving forward.

The Story is Already Written

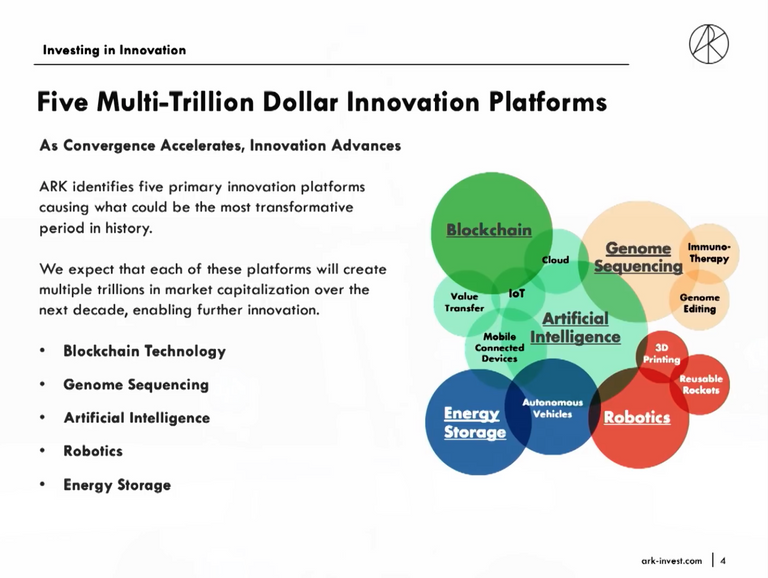

The impact of these technologies cannot go understated. Blockchain Technology, Genome Sequencing, Robotics, Energy Storage and AI are going to be at center stage for the future of humanity in the coming 5-50 years. Some of these technologies are far off from every day use while others have embedded early versions of the tech into our every day lives without us even realizing it.

Use AI as an example.. Most people have no idea that when they browse Facebook or Youtube and see “recommended” articles and various “algorithm-based” display choices, they are actually interacting with content fed to them by AI.

Artificial Intelligence is a spectrum. A lot of people think that AI is 100+ years away… but they don’t realize that AI is already among us. Just in a lesser form than the “Terminator” image that they have conjured up.

In fact, if you hear some scientists who are actually informed about the current state of AI talking about the technology as it works today, many believe that it has far more power than you could imagine. You’ve heard all the stories about how “Russian bots & hackers” rigged the U.S. election, right?

AI and social media algorithms are one and the same. Social Media is driving culture at an exponential pace and the conversations can (and already are) being manipulated by AI.

If you’d like to see an experiment in social media aglorithms, try this:

- Open a new browser window (a fresh profile)

- Go to YouTube

- Start using that browser to watch YouTube videos surrounding 1 particular subject (i.e. space technology, funny cat videos, etc.)

- After you get about 10-20 videos deep, start paying attention to your recommended feed… you’ll notice that it starts to feed you videos about that particular subject and surrounding subjects that are interleaved with it

It’s a small-scale experiment, but it works. You can see how AI can manipulate your “digital world” by simply encouraging you to view certain content. Now imagine how that looks 5-10 years from now as that AI technology continues to get smarter and smarter and smarter. Exponentially smarter.

Scary stuff. Or cool.. depends on how you view it and also how it is used (controlled) by giant corporations.

Blockchain is Already Here

AI isn’t the only technology that has creeped into the mainstream without people realizing it. Blockchain is already being integrated on a major scale and most people have no clue what it even is.

Within the crypto community, people often talk about how we will reach mainstream adoption and more importantly to them: when we will reach mainstream adoption.

In my opinion, we are still relatively far off from “mainstream” adoption. I’ll define mainstream as being everyday use by everyday people. When you go to the coffee shop and buy a cup of coffee using crypto or when you go to the hospital and your medical records are synced into a database that all hospitals can access.

The use cases for blockchain are still so new and so early. We are far from that level of “mainstream” adoption, but we are already expeirencing a major shiftt in the way people are transferring value on a global scale.

The key here is “global scale” — many of the people that I talk to locally (In the U.S.) have heard of Bitcoin, but don’t really care for it. They don’t need it. Why would they use some “digital currency” that isn’t backed nor secured by any regulatory body?

The people around me are not the people that need Bitcoin. The people that truly need Bitcoin and crypto fin-tech are the people who live in places like Venezuela where they can’t even trust their own government to protect the local currency.

In the States, we can rely on USD. Yes, there is a high inflation rate, but our issues are nothing compared to the issues people are facing in places like Venezuela. For this reason (and several others), we are seeing a massive amount of transaction volume flowing through networks like the Bitcoin blockchain.

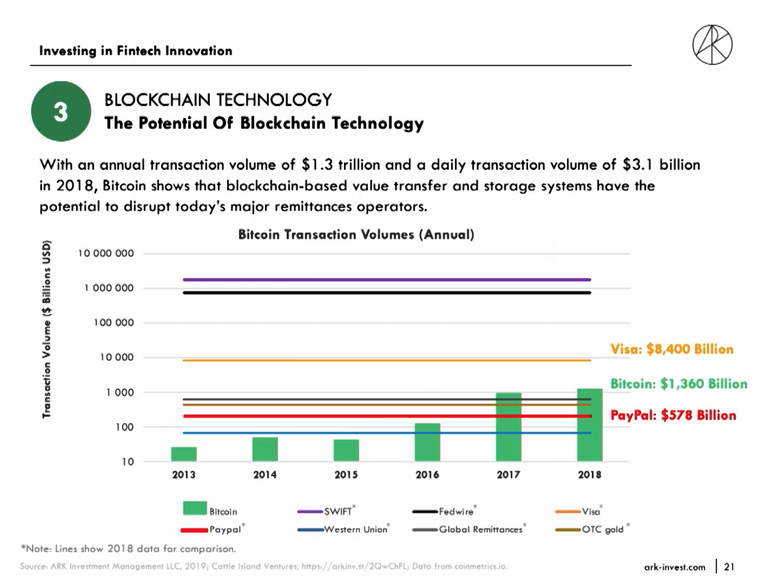

Cathie Woods talks about this a lot more toward the tail end of her presentation in South Africa, but the data does not lie. In fact, the data looks so good that many investors (particular ones from America) don’t believe the numbers shown above.

PayPal is an incredibly well-built network for payments. Visa is one of the largest players in the transaction landscape.

Bitcoin is 11 years old and it already has nearly triple the transacting (not trading.. transacting) volume of PayPal. It is growing exponentially and many people believe that Bitcoin will soon surpass the colossal payment networks such as Visa in terms of annual transaction volume.

That is truly insane. For a technology that most people claim to be in its “very early stages” (which I agree with), the fact that it is already starting to surpass some of these major financial outlets is mind-boggling.

Bitcoin is going to have many more improvement proposals. The network is going to go through many more tests. In the U.S. and similarly developed nations, using BTC to transact simply does not make sense. We can use USD with less of a hassle and honestly, I can send USD with less fees (0 fees, actually) to my friends.

Using BTC, I’d have to pay a network fee (which is small.. only a few USD), but it’s more than I’d be paying in terms of USD.

With that said, when I pay a developer or hire a freelance graphic designer who is from another country, I pay them in either BTC or STEEM.

The transaction goes through nearly instantaneously (less than 20 minutes for BTC and in 3 seconds for STEEM) and there is little to no fee associate with the TX. That freelancer then gets paid in a currency that cannot be taken nor devalued by their local government. They don’t have to wait days to get it and they can be assured that I cannot reverse the transaction once it is confirmed.

We are still at the beginning of this road, but many of these technologies (like AI and blockchain) are already walking amongst us in one form or another. The next 20 years will see a massive explosion in the ways that these technologies are leveraged in our every day lives.

This is getting a bit long. I’ll post a part two to this, which will cover the current and future landscape of fintech in particular. Be sure to check out the presentation by Cathie Woods, I really enjoyed it.

Posted via Steemleo

Best to learn and take advantage before AI and others beat you to it. It's either now or never. The shakeup which we are on the cusp of is going to leave most of humanity significantly behind. Bitcoin sometimes takes so long I'm worried, imagine waiting in line behind someone paying for a coffee with bitcoin, it will never work. Steem at 3 seconds is slightly annoying. XLM is fast.

Blockchains are just an application of the internet, software and computer technology.

I buy almost everything with Bitcoin. The difference is that to me the payment is handled by a quick tap of the finger to convert the btc to usd (cash app) and then I just swipe my card. It's stupid fast.

For the merchant, they only see USD.

I think this is the wave of the future. Processors that take our BTC or STEEM or XLM, but the merchants receive whatever currency they want to receive.

Posted via Steemleo

The future is awesome. Really hope there is something like this for JAHM in the Caribbean sometime soon. Clearing times don't matter as long as someone has trust. But BTC is still slow compared to Scot tokens 😸

I think the bigger the price of the token, slower the clearing time would be for "risks" reasons I guess.

Posted via Steemleo

Hi, @khaleelkazi!

You just got a 12.77% upvote from SteemPlus!

To get higher upvotes, earn more SteemPlus Points (SPP). On your Steemit wallet, check your SPP balance and click on "How to earn SPP?" to find out all the ways to earn.

If you're not using SteemPlus yet, please check our last posts in here to see the many ways in which SteemPlus can improve your Steem experience on Steemit and Busy.

The unique part of the Ark research team is their analysts are not industry specific. Look at most funds out there, they have specialized analysts who focus exclusively upon that particular industry. For example, the automotive analyst knows all about the car business but little about AI.

At Ark, they crossbreed their analysts so they have a holistic picture of what is taking place. This is something that is new to Wall Street. It is also why they can be so optimistic in their predictions. They are looking at things completely different from the norm.

People who are slow to change their way of thinking are going to be left behind. I see it on Steem, as an example, all the time. Even though people are in crypto, some of their thoughts are still from the 1990s.

Posted via Steemleo

Exactly, I love that type of cross-specialization. It's similar to what makes revolutionary entrepreneurs so successful at changing the world.. people like Elon Musk. They dip their toes in several different industries and gain a deep understanding of each and use that to tie together strategies and ideas that alter the fundamentals.

Posted via Steemleo

I used to mistaken bitcoin's origin to 2003. So Bitcoin is only 11 years old? Awesome!

Posted via Steemleo