Texas Instruments: Long-Term Outlook Is Shining Bright by Wealth Insights

Summary

- Texas Instruments provides semiconductors for high growth end markets that will continue to grow in the coming years.

- The company is a robust cash flow generator, and the non-capital intense nature of the business allows much of that cash to flow back to investors.

- The stock is trading above its historical norms, but long-term investors can benefit from buying into such a cash-rich business and holding for the long term.

When we look to identify a company poised to generate strong shareholder returns over the coming years, there are a couple of key "traits" that these businesses tend to possess. Such a company usually provides a product or service that is in high demand, and the company must be able to fulfill that demand in a manner that is profitable. Lastly, the company must provide multiple avenues of value to investors. This means that in addition to simply increasing a stock's intrinsic value (the company is worth more as the business earns more), additional value is provided in the form of dividends, and/or buybacks. Semiconductor producer Texas Instruments Incorporated (TXN) checks these boxes in spades. We review the company's strengths, and look at valuation - which is not as out of reach as one might expect in a hot stock market.

Strong Demand Through Strong Innovation

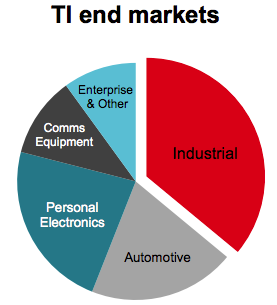

The first (and most obvious) requirement for a successful long-term business is that a demand exists for whatever product/service that business sells. Let's look at Texas Instruments' three largest end market segments. The company's largest end market is industrial-related. While the industrial segment is broken into a spectrum of specific applications, the largest contributors center around system, building, and grid automation/intelligence. Over the next five years, factory automation is projected to grow at an annual rate of more than 8%.

Source: Texas Instruments Incorporated

The company's second largest end market is automotive, where cars are becoming increasingly sophisticated on a technical level. This is especially true in the electric vehicle segment that is projected to make up as much as 14% of the US vehicle market by the year 2025. While Tesla Motors (TSLA) continues to push the conversation about EV forward, mainstream competitors such as Ford (F) and General Motors (GM) have well-publicized their support for EV and intentions to flesh out their line-up with electric options by the early 2020s. Considering the massive size of the US automotive market (more than 17 million cars sold each year), this would represent very strong growth for electric.

Lastly, the personal electronics segment - which is the most mature of the company's three largest segments. This will likely trail the others in growth due to years of smartphone expansion that have now saturated the market. However, the newest generation of wireless technology in 5G is just touching down and with it comes a massive upgrade cycle, as well as increased prominence of the "Internet of Things" (IoT). When you consider the room for modernization and advancement throughout Texas Instruments' core markets, it becomes evident that semiconductors will be needed for years to come.

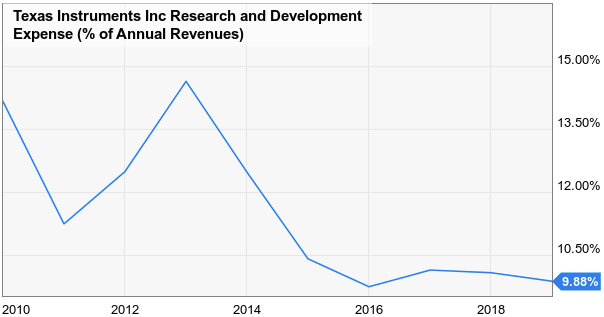

The rapid pace of advancement in these end markets necessitates innovation from Texas Instruments in the products that it designs/builds. The company takes this seriously, investing anywhere between 10%-15% of its revenues into R&D.

Source: YCharts

This spending rate is up there with some of the most innovative companies on the planet. It has enabled Texas Instruments to develop very advanced, and profitable technologies such as its 300mm Analog - which has expanded margins for Texas Instruments (more on that below).

Now, we have spent much of the past decade in a period of economic expansion, and a recessionary environment would curtail spending - especially in the automotive and industrial sectors. This would hurt Texas Instruments' business in the short term. The advantage of a long-term investment approach, is that eventually, these macroeconomic trends will continue on as the economic cycle resets. Short-term volatility won't prevent a long-term shift towards automation and cleaner transportation technologies.

Cash Generation Leads To Multiple Layers Of Shareholder Value-Add

When a company can meet demand with strong profitability, it signals that a business has a competitive advantage, or "moat." Texas Instruments has been able to increase its profitability over time.

... Read the Full Post On Wealth Insight's Seeking Alpha Page

Author Bio:

This article was written by Wealth Insights. A well-known investment author on Seeking Alpha with over 6,000 followers.

Steem Account: @wealth-insights

Profile on Seeking Alpha

Steem Account Status: Unclaimed

Are you Wealth Insights? If so, you have a Steem account that is unclaimed with pending cryptocurrency rewards sitting in it from your content. Your account was reserved by the Steemleo team and is receiving the rewards of all posts syndicated from your content on other sites.

If you want to claim this account and the rewards that it has been collecting, please contact the Steemleo team via twitter or discord to claim the account. You can also view the rewards currently sitting in the account by visiting the wallet page for this account.

What is Steemleo Content Syndication?

The Steemleo team is syndicating high-quality financial content from across the internet. We're also creating free Steem accounts for the authors of that content who have not yet discovered the Steem blockchain as a means to monetizing their content and we're listing those accounts as the 100% beneficiaries to all the rewards. If you want to learn more about Steemleo's content syndication strategy, click here.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://seekingalpha.com/article/4283722-texas-instruments-long-term-outlook-shining-bright