Why I'd Stay Away From Stocks

Hey Jesspeculators

Lol since I talk about money and finance all the time people simply assume I know what I'm doing. I honestly use my blog to share things I've read and researched to teach myself as well as those who are willing to take the time to read it.

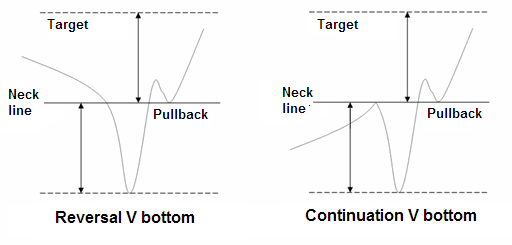

In the last few weeks, I've had quite a few people ask me if they should buy into stocks since the market has crashed and continues to and they feel they can get in on the cheap and wait for the V or U shaped to return to so-called normality.

I'm by no means a stocks guy and I'm not saying you can't make money in the stock market if you're willing to jump in and ride every fed put and then sell and go back in, but who I'm speaking to are those looking to invest long term. Those who want to keep stocks for a considerable period before selling.

Would it be advisable to stay in or even dollar cost average their current position? Let's see, shall we?

Image path - centralcharts.com

What is cheap

The name of the game is obviously to buy low now and sell high in the future, take your profits and run for the hills thinking what a genius you are at seeing this amazing trade. However, there is a big difference between buying low and selling high, and buying high and trying to sell at even higher.

The stock market has been inflated with cheap money for some time and stocks are extremely overpriced. The only reason it hasn't crashed lower is due to new money being printed and pumped in to bail out the rich and pension funds who have been holding these toxic assets.

The bubble has been made worse by stock buybacks reducing the number of shares in circulation and artificially creating scarcity to create shareholder value rather than improving these companies.

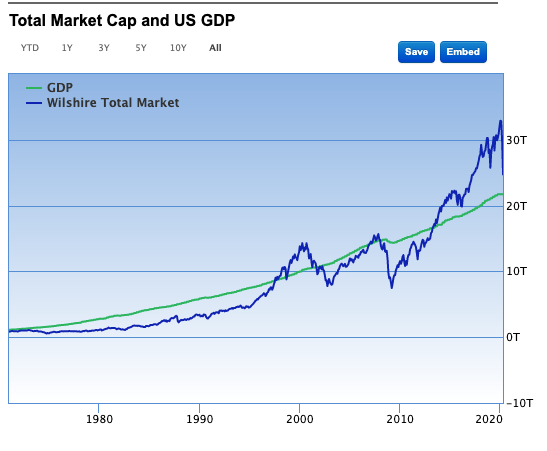

Market cap to GDP ratio

Humans are investors and humans like simple answers, the simplest answer is price go up good, price go down, bad. However, judging wherein the price range you are is a completely different story and to get a better perspective you need to look at other metrics like the market cap vs GDP ratio.

Currently, the stock market is considered moderately overvalued with the market cap being more than 113.8% higher than GDP.

The rate of valuation for evaluating

- Significantly Undervalued - Ratio < 50%

- Modestly Undervalued - 50% < Ratio < 75%

- Fair Valued - 75% < Ratio < 90%

So you can see we're well higher the ratio for stocks or the market to be considered "cheap"

Image source: - gurufocus.com

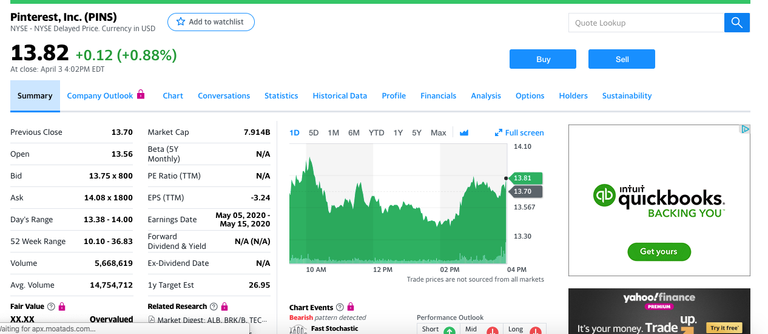

Checking an individual stock

While the market is overvalued there are always individual stocks you could look at, so let's take a look at some of those famous tech stocks that have had major IPOs of late and see what they're doing in the market. I chose Pinterest, Snapchat, Lyft and Uber, all big tech stocks that are IPOs had much fanfare.

Pinterest is trading at $13.82 down from $25 damn that's a bargain right?

- Market cap 8 Billion

- Earnings 1.14 Billion

- Losses 1.36 Billion

- Earnings Per share - 3.44 (negative)

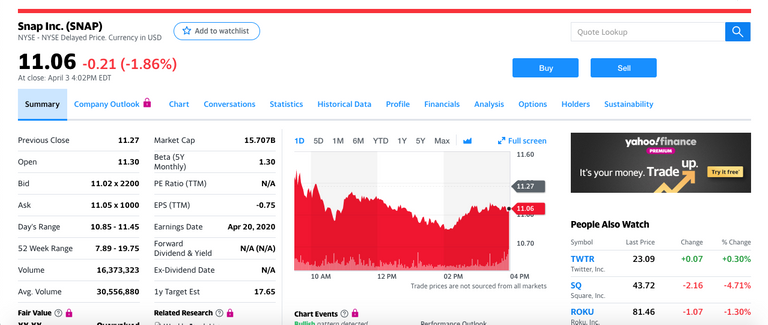

SnapChat

Snap Inc trades at a valuation of $11.06 and down from $17

- Market cap $16 Billion

- Earnings 1.73 Billion

- Losses 1.03 Billion

- Earnings Per share - $0.75 (negative)

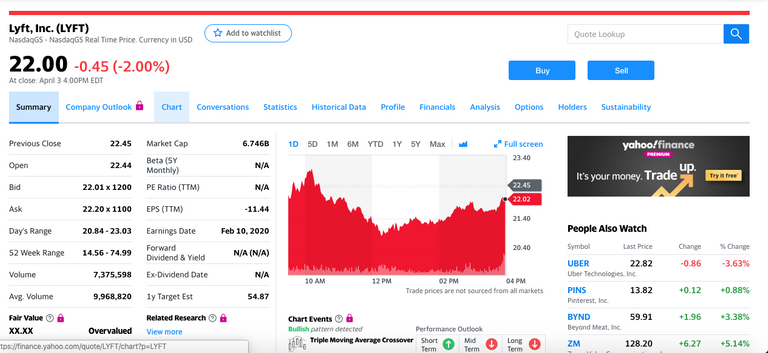

Lyft

Lyft trades at a valuation of $22 and its down from $54 in the last 3 months so 41% of its value gone, sounds cheap to me right? Well, let's look at what it's doing.

- Market cap $6.746 Billion

- Earnings $3.6 Billion

- Losses $2.60 Billion

- Earnings Per share -$11.44 (negative)

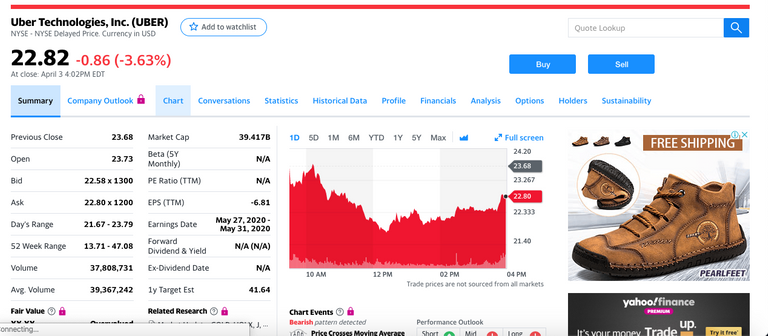

Uber

Uber currently trades at 22.82 down from 41.50, man that's a bargain right?

- Market cap $40 Billion

- Earnings $14 Billion

- Losses $8.5 Billion

- Earnings Per share - $6.81 (negative)

As you can see these companies may have lost market cap, may have dropped in price but they are by no means good investments, they're overpriced and burning up cash quicker than they can make it and not offering shareholders any value.

Why would anyone want to hold onto shares that don't make money and offer dividends unless its to dump it to another sucker?

A Fed put to a Fed save

So who could that sucker be? I could be wrong and we could see the FED come in and buy up all stocks and move it to their balance sheet to save every single stockholder and become the holder of last resort and centralise the ownership of the entire stock market.

They've not started unlimited QE to play around and they'll pull the trigger to bail out companies and stockholders balance sheets.

Have your say

What do you good people of HIVE think? Have you met or known a millionaire that has lost it all?

So have at it my Jessies! If you don't have something to comment, comment "I am a Jessie."

Let's connect

If you liked this post sprinkle it with an upvote or esteem and if you don't already, consider following me @chekohler

| Buy & sell STEEM | Donate LikeCoin For Free | Earn Interest On Crypto |

|---|---|---|

|  |  |

He said, 'Stop doing wrong things and turn back to God! The kingdom of heaven is almost here.'(Matthew 3:2)

Question from the Bible, Why would God pick a Filipino to be His messenger? [Pt. 3]

Watch the Video below to know the Answer...

(Sorry for sending this comment. We are not looking for our self profit, our intentions is to preach the words of God in any means possible.)

Comment what you understand of our Youtube Video to receive our full votes. We have 30,000 #HivePower, It's our little way to Thank you, our beloved friend.

Check our Discord Chat

Join our Official Community: https://peakd.com/c/hive-182074/created

Stock market is always tricky.

Exactly it can be like gambling and the only reason why hedge funds have been doing so well is because of all the money printing since 2008

Hi. If you dont Believe in stock you can still go short .

Or buy toiletpapercoin.

Take care !

Yes sure you can go short, but your average investor isn't going to be doing shorts, they want to buy and hopefully sell for a profit in the future, money in, money out lol. I'm trying to keep it simple here

Interesting analysis! but i am wondering on what to invest instead? recession, inflation etc, you got to place your wealth somewhere. Gold and Bitcoin alone are some good things to park your wealth but its not a really diversified investment. just thinking out loud

Gold and BTC I feel are relatively good, you can also do other precious metals like silver or palladium

Their are also companies that will thrive for example tiny house and motor home companies, futures contracts on agriculture as well as freelancing and recruitment software platforms

Online learning platforms too as the universities I feel have reached their peak of debt funded students

Outside companies I’d say their will be business opportunities for the brave as the pull back will be an over correction wiping out more businesses and needs will be high so looking at your local region for example what is now missing so all your laundromats are closed it’s an opportunity to buy up one on the cheap as the bank doesn’t want it and government might even assist and get it up and going

"...moderatly overvalued..."

Try, stocks are grossly and artificially overvalued especially Tech.

I'm still putting my cash into this.

Wow a silver Kruger rand that’s awesome I didn’t know you get those on your side! Lol should see if I can get some silver maple leaves they should be back to minting this week

It depends, id look at the earnings per share their are some still paying dividends and that’s where I’d focus not on buying hopefully to sell high!

Picked up a few of the KRs when silvergoldbull.ca put some up for sale on their website a year ago.

I'm not totally off Dividend stocks as long as they are still of reasonable long term value and remain well managed.