2020 Looks Tough For The Dollar by Michael A. Gayed

Summary

- Lower USD expected for 2020.

- The Fed will have a hard time fighting higher inflation while expanding the balance sheet.

- USD Index rising wedge broke lower pointing to further weakness.

- I do much more than just articles at The Lead-Lag Report: Members get access to model portfolios, regular updates, a chat room, and more. Get started today »

The man who will use his skill and constructive imagination to see how much he can give for a dollar, instead of how little he can give for a dollar, is bound to succeed. – Henry Ford

As the decade comes close to its end, it is time to look back at what happened with the world's reserve currency in 2019 and, more importantly, what is expected from the USD for the year ahead. No easy ride for USD bears this year – will 2020 bring more of the same, or is a reversal in the cards?

Some game changer events might trigger an ample move in the dollar. But equally important in any macro interpretation is not if the USD rises or falls, but against which currencies it does so. The Dollar Index offers a good balance – its weighted geometric mean shows the dollar’s value relative to a few select currencies like the Euro, the Japanese Yen, the Pound Sterling, the Canadian Dollar, the Swedish Krona and the Swiss Franc.

It is viewed by many as the benchmark for the overall USD value. In 2019 it continued the move higher from the previous year, albeit only making marginal highs. It peaked shy before reaching the 100 mark.

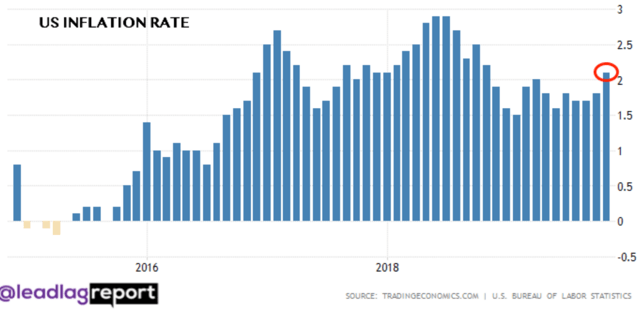

One of the recent Lead-Lag Reports I wrote focused on the USD, the Fed, and how inflation puts an interesting twist to the USD. This is something to watch in 2020. The inflation rate ticks up above the Fed’s 2% target for the first time in a year. All of that cheap money and consumer spending were bound to show up sooner or later.

December has seen steady declines in the USD index, indicating that any positive momentum it has been building could be fizzling out. The fact that the dollar has resumed its decline on Monday following the Friday jobs report induced spike suggests that sentiment is shifting to the negative.

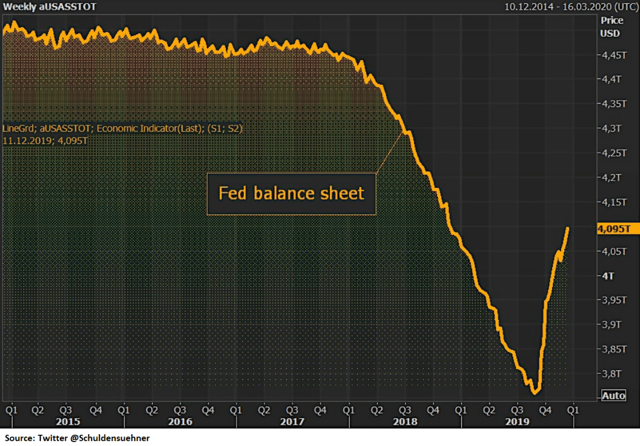

The puzzle for many investors comes from the Fed's actions. Higher inflation calls for hawkish steps from the Fed – but that's not happening so far. The Fed keeps expanding the balance sheet, in a process doomed to fully reverse the quantitative tightening started by the previous Fed Chair, Janet Yellen.

The Fed is not the only one inflating its balance sheet. It seems like a global race, with major central banks printing money in a frenzy. UBS expects the European Central Bank (ECB) balance sheet to hit five trillion euros in 2020 on TLTRO-III credits and QE program.

...Read the Full Article On Michael A. Gayed's Blog on Seeking Alpha

Author Bio:

This article was written by Michael A. Gayed. An author on Seeking Alpha and founder of the Lead Lag Report.

Steem Account: @leadlagreport

Twitter Account: leadlagreport

Learn more about Michael A. Gayed on Seeking Alpha

Steem Account Status: Unclaimed

Are you Michael A. Gayed (a.k.a. leadlagreport)? If so, you have a Steem account that is unclaimed with pending cryptocurrency rewards sitting in it from your content. Your account was reserved by the Steemleo team and is receiving the rewards of all posts syndicated from your content on other sites.

If you want to claim this account and the rewards that it has been collecting, please contact the Steemleo team via twitter or discord to claim the account. You can also view the rewards currently sitting in the account by visiting the wallet page for this account.

What is Steemleo Content Syndication?

The Steemleo community is syndicating high-quality financial content from across the internet. We're also creating free Steem accounts for the authors of that content who have not yet discovered the Steem blockchain as a means to monetizing their content and we're listing those accounts as the 100% beneficiaries to all the rewards. If you want to learn more about Steemleo's content syndication strategy, click here.

A theme to watch in 2020 is the Euro appreciating again the US dollar and money flowing into emerging markets...I have already made my popcorn, should be entertaining.