AmerisourceBergen: Consolidation Ending Soon by Michael A. Gayed

Summary

- AmerisourceBergen is well-positioned to benefit from aging demographics.

- The animal health market and a bet on biosimilars help too.

- Bullish pennant formation points to $155.

- Looking for a helping hand in the market? Members of The Lead-Lag Report get exclusive ideas and guidance to navigate any climate. Get started today »

The first wealth is health.

- Ralph Waldo Emerson

When health is an issue, we look for help. AmerisourceBergen (ABC) strives to shape the healthcare delivery industry by putting people first. A global corporation, it competes in one of the most promising sectors in terms of prospective growth for the years to come - health systems, pharmacies, physician practices, manufacturers, and animal health.

A KPMG research paper titled “Healthcare 2030” reveals the potential ahead. In the United States, the older population is expected to grow from 35 million to 74 million of the total population. That's a 21% increase. Longer-term trends project that people older than 65 will comprise a quarter of the US population by 2060. Moreover, the national healthcare industry is expected to reach 19% share of GDP by 2023. In 1960, it was only 5%.

Moreover, the same study shows that the number of people with three or more chronic diseases will reach 83.4 million in 2030, compared to only about 30 million in 2015. Costs are predicted to rise too - heart disease costs will triple by 2030 to 17% of total US spending on healthcare.

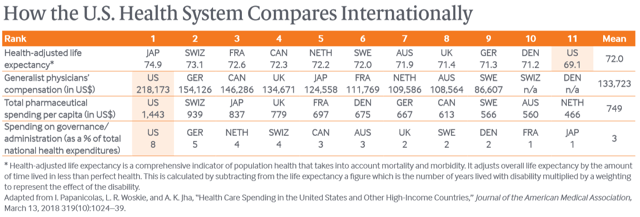

The US numbers aren't unique. While lagging the health-adjusted life expectancy (mean 72 years), it leads in total pharmaceutical spending per capita and in spending on governance. If we apply the US growth ratios discussed earlier to the other high-income countries presented below, the potential global growth becomes evident.

With a history of more than a hundred years in pharmaceutical sourcing and wholesale distribution, AmerisourceBergen stands to benefit from these trends. It operates as the backbone of the healthcare supply chain, recently spreading its wings in the global market. It ships 3 million products every day and has over 150 offices worldwide.

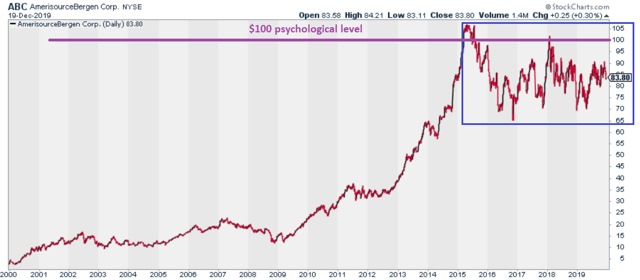

A bold move in 2015 is expected to produce lucrative results too - the company entered the animal health industry by acquiring MWI Veterinary Supply. Coincidence or not, that's about the moment its share price began to consolidate.

While the overall stock market pushed to new highs, AmerisourceBergen took its time to consolidate on a horizontal pattern. The $100 level seems to be a psychological one.

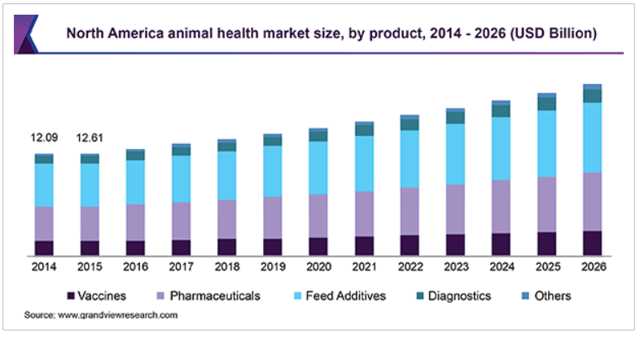

Coming back to the animal health line of business, the global market size was valued at $44.74 billion in 2018 and is projected to grow at a CAGR of 5% until 2026. The projected growth in the United States speaks of itself for why AmerisourceBergen entered the industry.

Moreover, a paper by Grand View Research reveals impressive trends for the industry - the total population will reach 9.7 billion in 2015, rising from 7.3 billion in 2019.

AmerisourceBergen has made yet another bold bet. It strongly believes in the promise of biosimilars to deliver cost savings across healthcare. Biosimilars are agents highly similar, but not identical, to a licensed biologic agent. Biosimilars have the potential to save the US healthcare system $44.2 billion over the next ten years - AmerisourceBergen offers solutions to increase access to these emerged therapies.

...Read the Full Article On Michael A. Gayed's Blog on Seeking Alpha

Author Bio:

This article was written by Michael A. Gayed. An author on Seeking Alpha and founder of the Lead Lag Report.

Steem Account: @leadlagreport

Twitter Account: leadlagreport

Learn more about Michael A. Gayed on Seeking Alpha

Steem Account Status: Unclaimed

Are you Michael A. Gayed (a.k.a. leadlagreport)? If so, you have a Steem account that is unclaimed with pending cryptocurrency rewards sitting in it from your content. Your account was reserved by the Steemleo team and is receiving the rewards of all posts syndicated from your content on other sites.

If you want to claim this account and the rewards that it has been collecting, please contact the Steemleo team via twitter or discord to claim the account. You can also view the rewards currently sitting in the account by visiting the wallet page for this account.

What is Steemleo Content Syndication?

The Steemleo community is syndicating high-quality financial content from across the internet. We're also creating free Steem accounts for the authors of that content who have not yet discovered the Steem blockchain as a means to monetizing their content and we're listing those accounts as the 100% beneficiaries to all the rewards. If you want to learn more about Steemleo's content syndication strategy, click here.

@tipu curate

Upvoted 👌 (Mana: 5/10 - need recharge?)

Nothing cooking with this stock, the weekly chart suggests to stay away until prices reach an extreme.