Assessing Brighthouse Financial At 0.3x Book Value by Ian Bezek

Summary

- Brighthouse Financial has now traded as an independent company for more than two years.

- Yet it still looks like an unloved spin-off trading at a massive discount to book value.

- Brighthouse seems like a reasonable speculation, that said, there are valid concerns around the stock.

- I'm not betting on the share price catching up to book value in the near term.

- Looking for a helping hand in the market? Members of Ian's Insider Corner get exclusive ideas and guidance to navigate any climate. Get started today »

I bought stock in annuity provider and life insurance firm Brighthouse Financial (BHF) in March 2018 for my IMF portfolio. It's not been one of my better picks; shares are down 20% since then while the market has gone up significantly. At the time of my purchase, Brighthouse stock seemed cheap. With the price down even more since then, is it time to back up the truck, or did I miss the mark on my initial analysis?

What's Brighthouse And Why Is It So Marked Down?

Life insurance giant Metlife (MET) spun off shares of Brighthouse Financial (BHF) as a separate company in 2017, and BHF stock started to trade around $70/share. The stock quickly dropped hard, leading me to take a position in the low $50s, assuming the usual dynamics about spin-offs applied. Brighthouse seemed unloved due to its small size, lack of a dividend, and complex business model. That runs opposite of the things that many MET stock owners desire, and thus, it wasn't surprising that BHF stock quickly slumped after the spin-off as loyal Metlife shareholders dumped their new BHF stock.

In fact, it looked like a textbook spin-off scenario where buyers get a great deal after the initial uncertainty. I enjoyed similar success with the Kontoor (KTB) spin-off earlier this year, it's a classic tool in the value investor's chest. And I was far from the only person to think that about Brighthouse, famed hedge fund manager David Einhorn stepped in buying a massive slug of Brighthouse stocks shortly after the spin-off. By May 2018, Einhorn had put 14% of his whole portfolio into Brighthouse with a cost basis around $57, and he continues to hold a large stake and talk positively about the company despite the continuing share price decline.

If you believe Einhorn, this is a misunderstood stock. Metlife spun off Brighthouse in part due to systemically important financial institution "SIFI" concerns; by spinning off Brighthouse, Metlife significantly shrunk its overall balance sheet and subsequently was able to avoid being ruled a SIFI, which would have increased its overhead dramatically.

In Brighthouse, Metlife spun off one of its more complicated divisions, variable annuities. These have an extremely high duration, as obligations can run for decades after a person retires. Thus, small changes in interest rates, life expectancy, and other such inputs can be the difference between having a solidly profitable business and one that is uneconomic.

Reasons For Skepticism

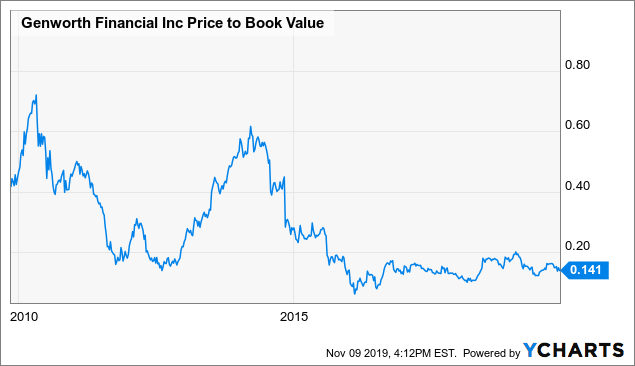

Bears made exactly that point in their analogy comparing Brighthouse to Genworth (GNW) last year. Genworth was an insurance spin off from GE (GE) that has struggled due to long-term health insurance contracts that ended up costing more than analysts had modeled. As a result, Genworth stock has traded at a drastic discount to purported book value for years as people don't take the numbers at face value:

ChartData by YCharts

A simple bear argument for Brighthouse would be that it too has hard to forecast inputs, such as interest rates and equity returns over decades, and any meaningful shortfall in either versus expectations could result in Brighthouse having an annuity book that is underwater with contracts lasting for decades. This, like Genworth, could leave the stock floundering at a massive discount to book value as that latter figure slowly erodes over the years. What good is a huge book value if it declines year after year as the company makes good on its obligations to policyholders?

Following the spin-off, Brighthouse reported earnings losses in large part due to hedges that it had on interest rates and the stock market to try to smooth out these risks. This led to falling book value figures and seemed to support the idea that Brighthouse had a bad policy book and that Metlife had used the spin-off to jettison dubious assets on an unsuspecting market.

That said, things should have changed in that regard this year, as Brighthouse's hedges started paying off in a big way. Yet the share price hasn't gone anywhere. Yes, shares are near 52-week highs and have recovered a bit from worst levels, but they're still way down from the spin-off price and where people like Einhorn started buying in:

ChartData by YCharts

In theory, however, the stock should have gone up a lot this year because the company has started reported positive earnings. Previously, Brighthouse had been losing money on a GAAP basis thanks to all those hedges it has in place on its investments. A rising market lifts the value of Brighthouse's assets but those gains aren't necessarily tabulated at the same time that it loses money on hedges.

Well, with the October-December 2018 stock market rout in particular, this negative swung to a positive. Brighthouse reported a jaw-dropping $12 of quarterly GAAP earnings in its February report. Yes, $12 per share, in one quarter:

...Originally Posted On Seeking Alpha

Author Bio:

Steem Account: @ianbezek

Twitter Account: irbezek

Steem Account Status: Unclaimed

Are you Ian Bezek? If so, you have a Steem account that is unclaimed with pending cryptocurrency rewards sitting in it from your content. Your account was reserved by the Steemleo team and is receiving the rewards of all posts syndicated from your content on other sites.

If you want to claim this account and the rewards that it has been collecting, please contact the Steemleo team via twitter or discord to claim the account. You can also view the rewards currently sitting in the account by visiting the wallet page for this account.

What is Steemleo Content Syndication?

The Steemleo community is syndicating high-quality financial content from across the internet. We're also creating free Steem accounts for the authors of that content who have not yet discovered the Steem blockchain as a means to monetizing their content and we're listing those accounts as the 100% beneficiaries to all the rewards. If you want to learn more about Steemleo's content syndication strategy, click here.

To listen to the audio version of this article click on the play image.

Brought to you by @tts. If you find it useful please consider upvoting this reply.