Billboard REITs: In Your Face, But Under The Radar by Brad Thomas

Summary

- For better or for worse, advertising billboards have become an unlikely symbol of "entrepreneurial Americana" and an inescapable fixture of the typical American commute.

- In the era of highly-personalized advertising, Out-of-Home (OOH) advertising remains an attractive and cost-effective medium for mass-market and local advertisers, immune from ad-blockers and fast-forwarding.

- Two Billboard REITs - Outfront and Lamar - control half of the country's 300,000 billboards. The conversion of static posters to digital displays will drive incremental revenue growth.

- Don't even think about trying to build any new billboards, as barriers to entry are significant and supply growth is non-existent. Billboard ownership, however, is an operationally-intensive, low-margin business.

- As growth-oriented REITs with hearty dividend yields and attractive valuations, billboard REITs are an under-the-radar REIT sector well-positioned for continued outperformance if the US economy continues to chug along.

- This idea was discussed in more depth with members of my private investing community, iREIT on Alpha. Get started today »

REIT Rankings: Billboards

In our REIT Rankings series, we analyze REITs within each of the commercial and residential sectors, focusing on property-level fundamentals and the macroeconomic forces driving overall supply and demand conditions. We then analyze REITs based on both common and unique valuation metrics, presenting investors with numerous options that fit their own investing style and risk/return objectives.

(Hoya Capital, Co-Produced with Brad Thomas through iREIT on Alpha)

Billboard REIT Sector Overview

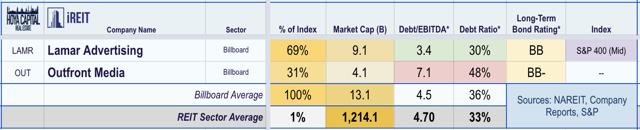

Emerging in the mid-2010s during the relatively short-lived 'REIT Conversion Craze,' we're excited to launch coverage on one of the newest REIT sectors. In the Hoya Capital Billboard REIT Index, we track the two billboard REITs, which account for roughly $13 billion in market value: Lamar Advertising (LAMR) and Outfront Media (OUT) which combine to control roughly half of all advertising billboards in the United States. We also track non-REIT Clear Channel Outdoor (CCO), which is the third-largest billboard operator. A growth-oriented sector that pays a healthy dividend yield, Billboard REITs comprise roughly 1% of the broad-based commercial Real Estate ETF (VNQ).

Billboard REITs are the largest players in the "Out-of-Home" (OHH) advertising market, which includes not only billboards but also transit displays and other static and digital signage designed to reach consumers while they're on the go. Outfront emerged in 2014 from a spin-off from CBS Outdoor, converting to a REIT soon thereafter while Lamar Advertising went public in 1996 and converted to a REIT in 2014. Clear Channel, meanwhile, remains a corporation but has explored a REIT conversion at various points in the last half-decade.

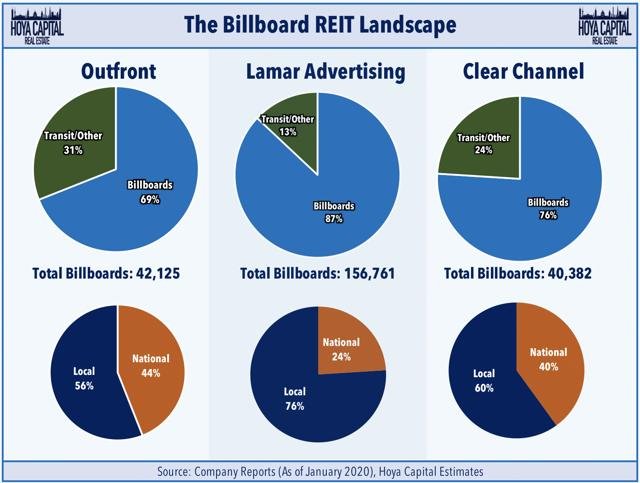

These companies derive around 75% of their revenues from billboards and the rest through transit advertising and other signage. Lamar operates as the most "pure-play" billboard company of the three while Outfront has a large transit-oriented business, highlighted by the company's massive transit deal with the Metropolitan Transportation Authority (MTA). As we'll discuss in more detail, billboard REITs are an operationally-intensive business with the majority of revenues driven by local advertising sales.

In the era of highly-personalized advertising and advanced tracking and ad-conversion metrics, OHH remains an attractive and cost-effective medium for mass-market and local advertisers as ads can't be skipped, blocked, fast-forwarded, or consumed by "bots." Spending on OHH advertising remains a small, but steadily growing segment of the advertising landscape. A report from PwC shows that spending on OHH is expected to rise roughly 3% per year through mid-2023, the second-strongest rate of growth behind internet advertising. These REITs are in the process of converting many of the highest-value locations from static billboards into digital display boards, which can bring in 2-4 times more revenue than typical static display boards.

...Originally Posted On Seeking Alpha

Author Bio:

Steem Account: @bradthomas

Twitter Account: rbradthomas

Steem Account Status: Unclaimed

Are you Brad Thomas? If so, you have a Steem account that is unclaimed with pending cryptocurrency rewards sitting in it from your content. Your account was reserved by the Steemleo team and is receiving the rewards of all posts syndicated from your content on other sites.

If you want to claim this account and the rewards that it has been collecting, please contact the Steemleo team via twitter or discord to claim the account. You can also view the rewards currently sitting in the account by visiting the wallet page for this account.

What is Steemleo Content Syndication?

The Steemleo community is syndicating high-quality financial content from across the internet. We're also creating free Steem accounts for the authors of that content who have not yet discovered the Steem blockchain as a means to monetizing their content and we're listing those accounts as the 100% beneficiaries to all the rewards. If you want to learn more about Steemleo's content syndication strategy, click here.