EOG Resources Doesn't Seem To Slow Down by Fun Trading

Summary

- The company announced third quarter 2019 net income of $615.1 million, or $1.06 per share, compared with third quarter 2018 net income of $1,191 million, or $2.05 per share.

- EOG Resources' oil production exceeded the high end of its guidance range during the third quarter. Total production was a record of 834.2K Boep/d, up 11.4% from last year.

- This oil company is another perfect example of my basic strategy attached to the entire oil sector.

Image: EOG rig from EOG Resources

Investment Thesis

The Houston-based EOG Resources (EOG) is one of the top-tier US shale players that I regularly cover on Seeking Alpha.

I like EOG because of its pragmatic management that has followed a rigorous strategy over the years that resulted in steady growth.

EOG Resources presents a rock-solid balance sheet with substantial growth potential. It makes the stock an excellent long-term candidate, especially after nearly a 20% drop since January, despite what I consider stellar results realized in a weak oil and gas price environment.

However, this oil company is another perfect example of my basic strategy attached to the entire oil sector. The investment thesis is quite simple.

First, you identify a reliable company with a solid track record producing excellent cash flow, where you are confident to invest and accumulate for the long term. A company with a good dividend yield is even better. EOG Resources is paying a low dividend yield of 1.56%, which is quite harmful.

Second, you have to be willing to trade about 30% of your position by using short-term volatility. It is an essential part of the strategy and will provide you with better control of your investment.

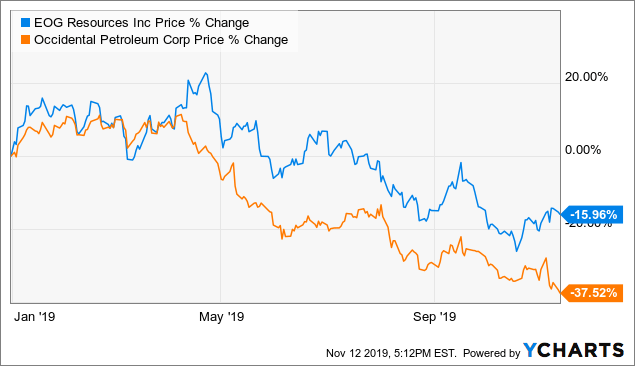

This successful US Shale producer can be compared with Occidental Petroleum (OXY), which is also involved with the US Shale almost exclusively and is the leader in the Permian Basin. The stock has underperformed EOG since the start of 2019.

The chart below is showing a 22% differential, mostly attributable to the ill-timed Anadarko acquisition.

ChartData by YCharts

What makes EOG a good business?

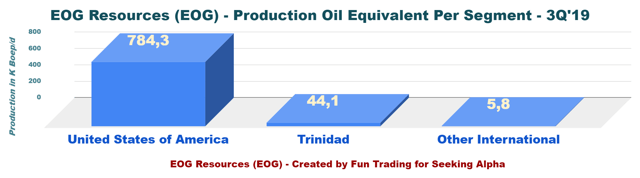

The company is primarily producing oil and gas from the US Shale or 94% of the total output in 3Q '19.

...Read the Full Post On Seeking Alpha

Author Bio:

Steem Account: @funtrading

Seeking Alpha Account: Fun Trading

Steem Account Status: Unclaimed

Are you Fun Trading? If so, you have a Steem account that is unclaimed with pending cryptocurrency rewards sitting in it from your content. Your account was reserved by the Steemleo team and is receiving the rewards of all posts syndicated from your content on other sites.

If you want to claim this account and the rewards that it has been collecting, please contact the Steemleo team via twitter or discord to claim the account. You can also view the rewards currently sitting in the account by visiting the wallet page for this account.

What is Steemleo Content Syndication?

The Steemleo community is syndicating high-quality financial content from across the internet. We're also creating free Steem accounts for the authors of that content who have not yet discovered the Steem blockchain as a means to monetizing their content and we're listing those accounts as the 100% beneficiaries to all the rewards. If you want to learn more about Steemleo's content syndication strategy, click here.

Not really filling EOG with such a low dividend yield despite the drop in price. However, it's nearing a buy level. The chart suggest if it can get to $60, go long with a target at $80.