Evaluating The Current Viability Of Smucker's 'Moat' by Wealth Insights

Summary

- J.M. Smucker is still looking for operational consistency following its organizational restructure around pet food and coffee.

- In the pursuit of growth, Smucker seems to have taken on volatility by increasing exposure to sectors with extreme competition and sensitivity to commodity prices.

- We remain shareholders of Smucker for the time being, but investors need to objectively look at the "new" Smucker's long term competitive capabilities.

As a current shareholder of The J.M. Smucker Company (SJM), we last discussed the company in August when we outlined how important the upcoming year was. The company has restructured itself around primarily two core competencies in Pet Food/Snacks and Coffee.

The cost Smucker paid to undergo this transformation wasn't cheap (see Big Heart and Ainsworth acquisitions), and the company is still in the process of digging out of a sizable pile of debt that has the company leveraged at more than 4X EBITDA. We have known that the process to deleverage the balance sheet would require patience, but the latest poor quarter put up by the business has raised concerns about the long term strength of the business. We aren't pulling the alarm here yet, but we wouldn't be objective if we didn't start scrutinizing the company's competitive strengths and weaknesses at this point.

How Strong Are The Pet & Coffee Segments?

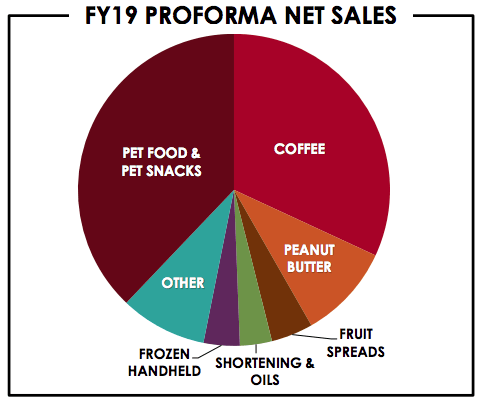

While Smucker's business was more diverse between coffee and various types of food products prior to the Big Heart Pet Brands deal, today the business is skewed heavily towards pet food and coffee. Food products have taken somewhat of a back seat.

source: The J.M. Smucker Company

These moves were intended to tap into what is generally seen as a growth market (a similar pet focused strategy has been utilized by peers including General Mills (NYSE:GIS)). However, life following the dive into pet food has seen some noticeable bumps. While Smucker still holds a handful of well renowned brands (such as Smucker's and Jif), those brands are outweighed by the pet food and coffee segments. The pet food segment has seen uneven performance due to the sector as a whole being fiercely competitive. Smucker is currently working on an ugly streak of six quarters since the pet foods business has posted positive organic volume growth.

Meanwhile, the coffee business has seen its own set of challenges. Competitive pricing driven by very low commodity prices have resulted in margin pressure on Smucker. Even though a business will typically try to hedge exposure to commodity fluctuations with contracts, this past quarter still saw the coffee business take a 13% profit hit year over year.

These are at least partially short term challenges. It's reasonable to expect coffee prices to eventually become more favorable, and for management to find its way in the pet food business. However there is clear evidence that while these strategic business segments offer more potential growth, they seem to lack the stability of Smucker's legacy brands. With a lesser "moat" around Smucker's business, we are witnessing the impact of outside pressures in the form of soft earnings numbers.

Deleveraging Is Tying A Hand Behind Management's Back

The longer that these business segments struggle, the more heat management will feel from shareholders to get things moving in the right direction. This puts management in a bit of a tight space in regards to the balance sheet.

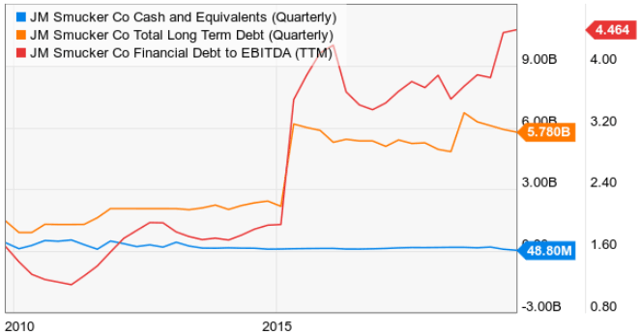

source: Ycharts

Smucker has traditionally run a tight fiscal ship, with leverage levels consistently in check over the years. This changed when Smucker made its blockbuster acquisitions of Big Heart Pet Brands ($5.8B) and Ainsworth ($1.7B). Since 2015, debt levels have hovered around 4X EBITDA which is well above our typical 2.5X threshold of concern.

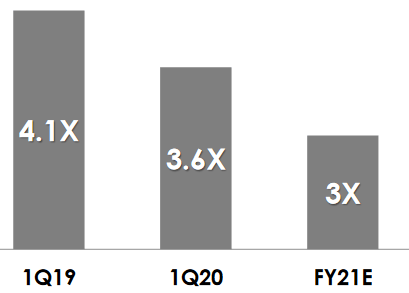

source: The J.M. Smucker Company

Smucker has been steadily paying down debt to deleverage the balance sheet, but the problem is that this process is going to take some time. Management is predicting that leverage will be back down to 3X by the end of fiscal year 2021, which is seven quarters from the time this article was written. We have discussed this timeline in the past, and are generally OK with this. The prudent long term move here is to deleverage. However, the more the business struggles, the more difficult it becomes to digest such a long and tedious endeavor.

Author Bio:

This article was written by Wealth Insights. A well-known investment author on Seeking Alpha with over 6,000 followers.

Steem Account: @wealth-insights

Profile on Seeking Alpha

Steem Account Status: Unclaimed

Are you Wealth Insights? If so, you have a Steem account that is unclaimed with pending cryptocurrency rewards sitting in it from your content. Your account was reserved by the Steemleo team and is receiving the rewards of all posts syndicated from your content on other sites.

If you want to claim this account and the rewards that it has been collecting, please contact the Steemleo team via twitter or discord to claim the account. You can also view the rewards currently sitting in the account by visiting the wallet page for this account.

What is Steemleo Content Syndication?

The Steemleo team is syndicating high-quality financial content from across the internet. We're also creating free Steem accounts for the authors of that content who have not yet discovered the Steem blockchain as a means to monetizing their content and we're listing those accounts as the 100% beneficiaries to all the rewards. If you want to learn more about Steemleo's content syndication strategy, click here.

To listen to the audio version of this article click on the play image.

Brought to you by @tts. If you find it useful please consider upvoting this reply.

Thank you for posting from the https://steemleo.com interface 🦁

Congratulations @leo.syndication! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!