Sentiment Speaks: Gold Investors Wrongly Fear The COT by Avi Gilburt

Summary

- Many investors are getting spooked because of the COT report.

- If you look at history, you will see that the COT is relatively meaningless during bull markets in gold.

- Until some support breaks in gold, you should discount this report.

- This idea was discussed in more depth with members of my private investing community, The Market Pinball Wizard. Get started today »

As a student of market history, I always find it interesting, and even sometimes quite comical, how certain fallacies about markets are continually propagated by investors and analysts alike. Throughout my career in writing about metals, I have tried to bring many of these to light, and explain why so many of the fallacies should be ignored.

The latest in the string of fallacies relates to the Commitment of Traders report (COT). The common argument suggests that as long as the commercial traders are shorting gold heavily, then gold cannot rally. And much has been made of late regarding the heavy commercial short positions pointing to a major drop in the gold market. Yet, history suggests otherwise.

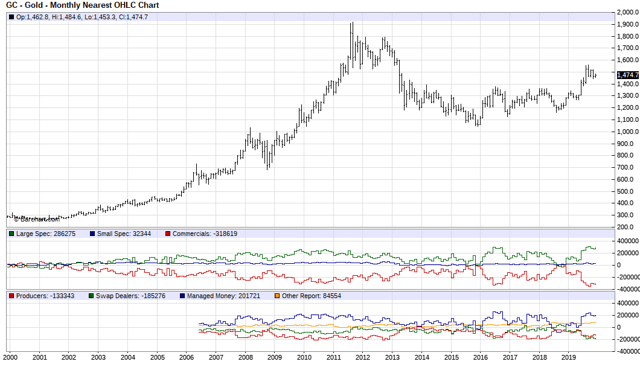

If you look at the below chart for the last 20 years, you will see that during the parabolic rally of 2010-2011 in the price of gold, the commercial traders were heavily short gold. In fact, you can see that during that entire period of time, commercial shorts remained at 200,000 or greater. Yet, that was during a period of time where the price of gold rallied $800. For those counting in percentage terms, that means gold rallied 70%+ during a time where commercial traders were heavily short of gold.

You see, just like technicals have to be read differently during bull markets versus bear markets, so does the COT. During bear markets, when the technicals reach an overbought level, then it often suggests the market will likely begin a selling phase. However, in a bull market, when the technicals reach an overbought level, rather than suggesting selling will result, the technicals often embed during the strong advance of a bull market. The same will often happen with the COT. So, applying a linear expectation to the COT data will not often result in the appropriate trading result.

This really means that support and resistance are much more important to metals investors/traders than the COT report. Moreover, the structure of the move in the metals complex will also tell us a lot more than the COT report. Remember, history has shown us that if the market is in a bullish phase, then the COT report will be meaningless.

So, at this point in time, there are several ways you can view the COT report, if you really care about it. Either the commercial shorts will cover their shorts on the next corrective pullback I expect in early 2020 or the market will simply continue on its merry way with the commercial shorts being... well... short, no different than what we saw in 2010-2011.

But, as I said, history has told us that this report is not going to provide any predictive value when the metals are in a bull phase. If we do morph into a bear phase, then it will mean a lot more. But, until we break some support (137 GLD), this report should not be heavily weighted within trading/investing decisions.

...Read the Full Post On Seeking Alpha

Author Bio:

Steem Account: @avigilburt

Seeking Alpha Account: Avi Gilburt

Steem Account Status: Unclaimed

Are you Avi Gilburt? If so, you have a Steem account that is unclaimed with pending cryptocurrency rewards sitting in it from your content. Your account was reserved by the Steemleo team and is receiving the rewards of all posts syndicated from your content on other sites.

If you want to claim this account and the rewards that it has been collecting, please contact the Steemleo team via twitter or discord to claim the account. You can also view the rewards currently sitting in the account by visiting the wallet page for this account.

What is Steemleo Content Syndication?

The Steemleo community is syndicating high-quality financial content from across the internet. We're also creating free Steem accounts for the authors of that content who have not yet discovered the Steem blockchain as a means to monetizing their content and we're listing those accounts as the 100% beneficiaries to all the rewards. If you want to learn more about Steemleo's content syndication strategy, click here.

I love the COT report, it predicted the turn in price in Dec 2019.