What Is It To Be A Canadian Dividend Investor? by The Dividend Guy

Summary

- While I prefer to invest a good part of my money in the U.S. market (for diversification and potential), I am now able to find some hidden gems in the Canadian market.

- Evolving in an oligopoly protected by the government, Canadian banks use their core business to generate strong cash flow and growth through various strategies.

- The biggest challenge for Canadian investors is to find a considerable yield (3-4%) in various sectors.

- This idea was discussed in more depth with members of my private investing community, Dividend Growth Rocks.

I remember my first trades on the market back in 2003 when I was 22 and starting both my career in the financial industry and my investing journey. I was fortunate enough to avoid high fees from mutual funds and start directly with an online broker account.

The first thing I did after opening it was to buy shares of Power Corporation (POW) (OTCPK:PWCDF). My investment thesis? I worked for a business unit in partnership with many of POW companies. I thought it was smart. (You can see how I evolved into a more articulate investor since then! Haha!)

After pulling out a few stock filters out on the Canadian market, I realized how difficult it was to build a 100% Canadian portfolio. Banks, telecoms, energy and basic materials stocks were omnipresent among my holdings. While those were the good years to be in the market, I felt limited in my options.

As I experienced various strategies and read many books and articles, I've built a complete and meticulous investing process. While I prefer to invest a good part of my money in the U.S. market (for diversification and potential), I am now able to find some hidden gems in the Canadian market.

Today, I wanted to share my view on what it's like to be a Canadian investor. I'm sure you will recognize many of the goods sides and struggles we face. I'll also tell you how I managed them.

Limited Sector Allocation

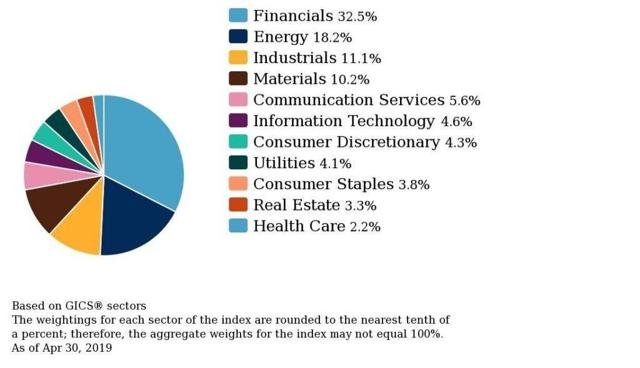

First, investing in the Canadian market initially meant being stuck with 50% of the market cap concentrated into 2 sectors: Financials and Energy. Financials are led by the Big 5 (the 5 largest Canadian Banks) who are renowned to represent one of the strongest and most stable banking systems in the world. Then, you have a few great insurance companies such as Sun Life (NYSE:SLF) (OTC:SLFYF), Manulife (NYSE:MFC), and Great-West Lifeco [GWO] (OTCPK:GWLIF) and a few more conglomerates such as Brookfield Asset Management (NYSE:BAM) and Power Corp.

The energy sector finds its power mostly in Northern Alberta with the oil sand. There were the good old days of the oil income trust until the government shut down this plan on Halloween (yes, it was a horror story for many income-seeking investors!). Once I was done with those two sectors, I had only 50% of the market capitalization left to build a solid portfolio:

If you are a dividend investor like me, you will find it very hard to find dividend growers among basic materials, technology, and consumer (both staples and discretionary). The problem with consumer stocks is usually their very low yield. Still, I found a few interesting picks in those sectors throughout time. However, you won't find any Disney (NYSE:DIS), Starbucks (NASDAQ:SBUX) or Coca-Cola (NYSE:KO) among Canadian companies. The most important problem with most sectors is that very few businesses have international exposure.

Don't fall for energy & basic materials

My first thought when I look at the TSX sector allocation is "don't fall for the trendy stocks". Many energy and materials companies have their 15 minutes of fame from such things as an oil boom, a new mine, or explosive demand for a commodity. That kind of news makes any investor's dream as the stock usually skyrockets and making a small fortune for shareholders. I was part of the dreamers too before I became a dividend growth investor.

After making lots of money from oil income trust (my 7-year-old could have made those picks for me), I decided to make a play on a big news. I bought a bunch of shares of a small mining company (penny stock) before it posted their exploration results. This worked for a few months as I was making over 100% return and then, boom! One day, I came back from lunch and I had lost 50% of my initial investment. The stock plummeted to new lows since the company discovered… nothing.

While not all play or "do or die" investments, this story taught me a lesson: "commodities-related businesses are volatile". Many Canadians complain they haven't had much of a return in the past 5 years. When you look at their portfolio, you realize that the bulk of their money is invested like the TSX60… Lots of energy and resources stocks.

Struggling with the U.S. currency rate

The best way to improve my portfolio diversification as a Canadian was to look elsewhere. As I mentioned, the Canadian market doesn't include many international consumer staple, cyclical, industrial or tech stocks. I recently explained why I would rather invest in US stocks to cover international diversification. We are talking about the world's largest, most stable, and most diversified stock market.

... Read the Full Article on Seeking Alpha

Author Bio:

This article was written by The Dividend Guy. A well-known investment author on Seeking Alpha.

Steem Account: @thedividendguy

Twitter: thedividendguy

Steem Account Status: Unclaimed

Are you The Dividend Guy? If so, you have a Steem account that is unclaimed with pending cryptocurrency rewards sitting in it from your content. Your account was reserved by the Steemleo team and is receiving the rewards of all posts syndicated from your content on other sites.

If you want to claim this account and the rewards that it has been collecting, please contact the Steemleo team via twitter or discord to claim the account. You can also view the rewards currently sitting in the account by visiting the wallet page for this account.

What is Steemleo Content Syndication?

The Steemleo team is syndicating high-quality financial content from across the internet. We're also creating free Steem accounts for the authors of that content who have not yet discovered the Steem blockchain as a means to monetizing their content and we're listing those accounts as the 100% beneficiaries to all the rewards. If you want to learn more about Steemleo's content syndication strategy, click here.

Thank you for posting from the https://steemleo.com interface 🦁

Congratulations @leo.syndication! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!