ETH 2.0 is here. Can I still buy mining machines to mine Ethereum? What are the benefits of Ethereum mining?

Multiple Bitcoin price indicators show that even if Bitcoin falls below $22,000, securities traders are still optimistic about Bitcoin.

As the bitcoin price tested a low of $17,580 on December 11, some analysts also issued bearish expectations, but investors remained relatively calm. Although last week's trading may be the same as when the market opened, the fundamentals of Bitcoin have become stronger.

BTC/USD 4-hour chart. Source: TradingView

Every time Bitcoin reaches a new high, investors expect some form of adjustment. Although it failed to break the resistance level of $24,000, the price quickly rebounded from the low of below $22,000 on December 21. This incident may give sellers some hope, but analysts believe that there is no sign of weakness.

In the past week, Bitcoin's dominance continued to rise, climbing from 64.3% to 67.3%. This is due to the Dubai-based financial consulting firm deVere Group's forecast of US$46,000 in 2021. In addition, the Chicago Mercantile Exchange futures contract exceeds 1.3 billion US dollars. This also proves an indisputable fact that the participation of institutions in the BTC market is constantly increasing.

This fact seems to give investors more confidence. Bitcoin reached $24,300 on December 20, a record high.

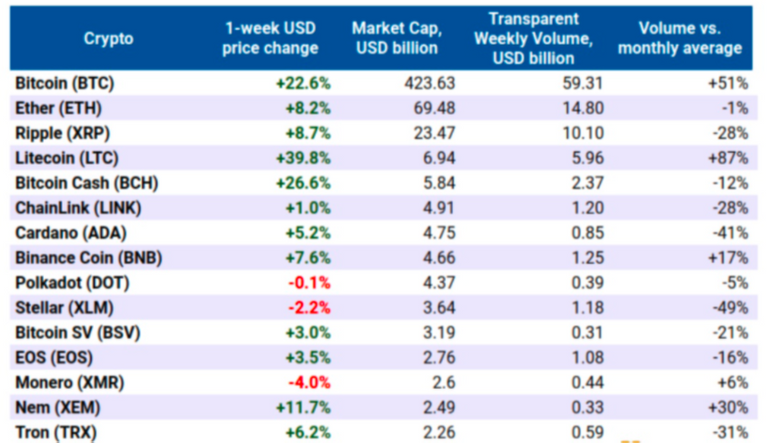

The top 16 weekly performance of crypto assets. Source: Nomics&CoinMarketCap

In the past week, Bitcoin has outperformed other crypto assets in the top 15 with an average increase of 7.7%. More importantly, compared with Bitcoin's 50% growth rate, the trading volume of other crypto assets is disappointing. This indicator has strengthened the recent superior performance, and BTC will use $22,500 as a new support.

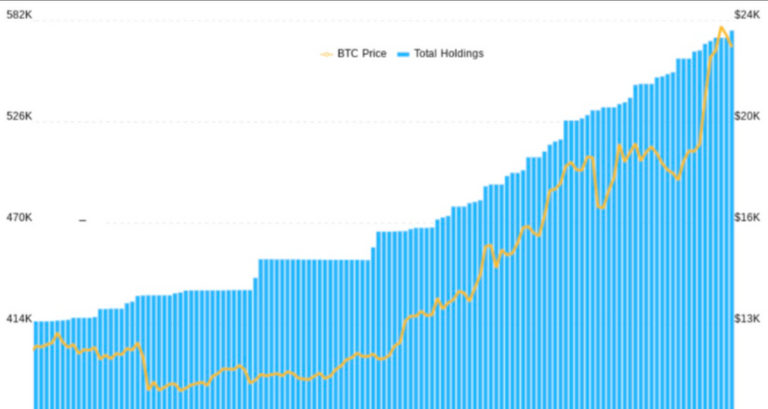

Institutional investors accumulate and Bitcoin price consolidates

Crypto fund management company Grayscale Investments also continues to actively add BTC to its portfolio, which currently has $13.3 billion in bitcoin.

Grayscale Investments BTC shares Source: bybt.com

In the past week, 11,620 BTC have been added, for a total of 576,650 BTC. Therefore, this is another excellent week for Grayscale Bitcoin Trust. By analyzing the fund's premium to the effective BTC held per share, a similar excitement can be seen. The effective BTC of the fund is currently 0.00095064.

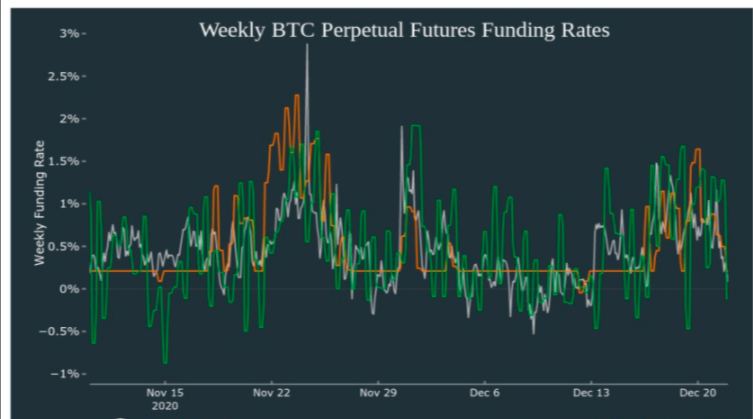

Perpetual futures funds remain stable

Perpetual contracts, also called reverse swaps, have a fixed interest rate, which is usually charged every 8 hours. The financing interest rate ensures that there is no exchange rate risk imbalance. Even if the public interest of the buyer and the seller are the same at all times, the leverage ratio may be different. When the buyer (long) needs more leverage, the financing rate becomes positive. Therefore, the buyer will be the one who pays the fee. This problem is especially true during bull markets, as long stocks are usually in greater demand.

A sustainable growth rate of more than 2% per week means extreme optimism. This level is acceptable during a market rebound, but if the BTC price is horizontal or in a downward trend, there will be problems.

In this case, when prices suddenly fall, high leverage from buyers increases the possibility of large-scale liquidation.

BTC perpetual futures financing interest rate. Source: Digital Asset Data

Please note that despite Bitcoin's weak performance on December 21, the weekly financing rate managed to avoid negative growth. "This data shows that short (sell) and long (buy) traders use roughly the same leverage."

This is a neutral stat, because both parties have the opportunity to increase their bets.

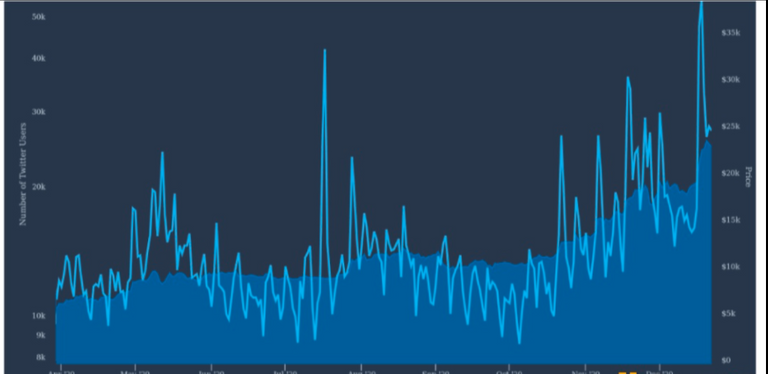

Social network activity reaches its peak

BTC Twitter user activity and USD price Source: TheTie

The data from TheTie also shows that the price of BTC has risen recently, while tweets related to "Bitcoin" have reached the highest level since December 2017. Although the social activity indicators have been revised recently, the current level is still 10% higher than last month.

Although the substantial increase in Twitter activity does not necessarily equate to active retail purchases, as crypto assets continue to rise, this will undoubtedly help attract more attention.

Option call ratio

The best way to measure overall market sentiment is whether to call (buy) options or put (sell) options. Generally speaking, call options are used for call strategies, and put options are used for put strategies.

The ratio of put options to call options is 0.70, indicating that the open interest rate of call options is 30% higher than the open interest rate of put options, so the trend of call options is better.

In contrast, the 1.20 indicator tends to 20% for puts, which can be considered a bearish. One thing to note is that this indicator summarizes the entire BTC options market, including all calendar months.

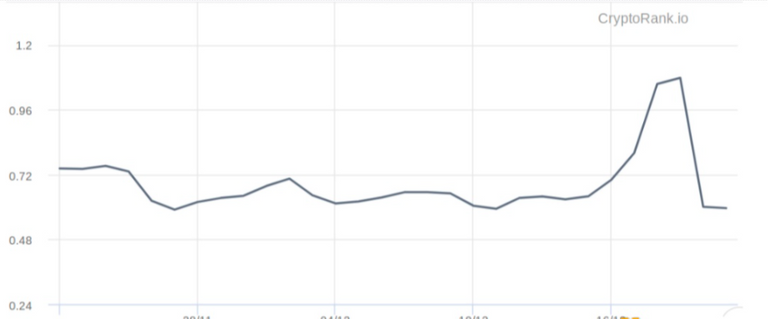

BTC options call ratio. Source: Cryptorank.io

As the price of Bitcoin exceeded $20,000, investors sought downside protection. Therefore, the bullish ratio reached a peak of 1.08 on December 19.

This shows that investor optimism has not been affected by the 10% price adjustment after hitting an all-time high of $24,200.

Bitcoin currently holds $22,500, traders remain optimistic

"Overall, every indicator discussed quickly returned to the neutral to bullish range, which is relatively optimistic given that the market recently tested the low of $21,910."

With the performance of BTC remaining above $22,500, investors still maintain an optimistic attitude, and the continuous rebound after each decline is a positive sign.

This article is a translation, the content is for information transmission and does not constitute any investment advice.

Posted Using [LeoFinance Beta](https://leofinance.io/@airdropshiper/eth-2-0-is-here-can-i-still-buy-mining-machines-to-mine-ethereum-what-are-the-benefits-of-ethereum-mining)

Posted Using [LeoFinance Beta](https://leofinance.io/@airdropshiper/eth-2-0-is-here-can-i-still-buy-mining-machines-to-mine-ethereum-what-are-the-benefits-of-ethereum-mining)