Yield Farming At 1inch

I was looking out intentionally for opportunities for yield farming to earn extra passive income after my successful experience at Cake Defi that I had experience in staking and liquidity mining of DFI tokens.

With DFI tokens being pumped so extensively, DFI tokens became really profitable for me since my first investment in it.

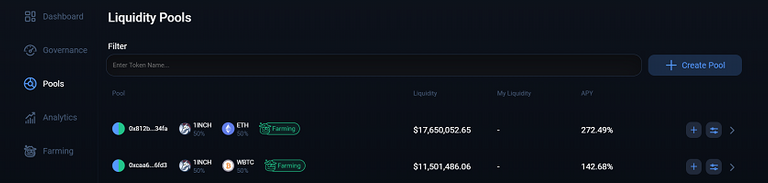

I found out that Coingecko has collated a list of top yield farming pools by the value locked.

https://www.coingecko.com/en/yield-farming

It was good reference but I must admit that there is definitely a high degree of risk if we just jumped in a liquid pool because of high APY since we are really putting our money into the pool without our control to earn reward.

The decentralized finance platform called 1inch has definitely caught my attention since I did read about its recent airdrop for those who had registered their wallets before 24 December 2020.

The support of 1inch from Binance recently had made the token pumped from $0.2 to as high as $2.60 shortly on 25 December 2020.

https://www.medianews.ca/2020/12/27/defi-token-1inch-spikes-1000-in-christmas-after-binance-listing/

Nevertheless, the excitement did die down. The current price of 1inch is around $1.24.

From the collection from Coingecko, I notice that 1inch has farming pools that are above 400% APY. This percentage will probably change when more people provide liquidity to its pool.

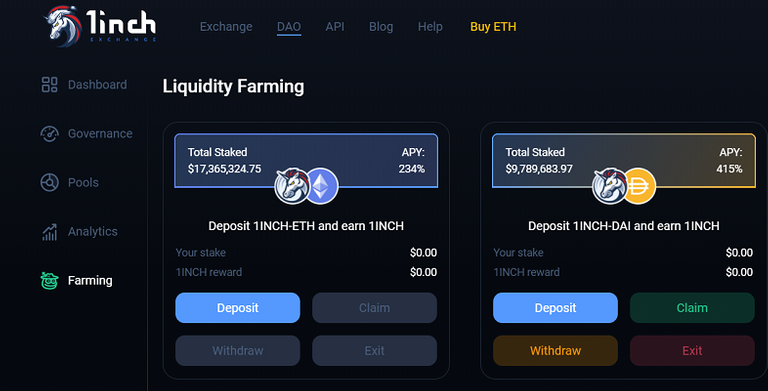

I am using Metamask and I had to get 1inch as well as another token to provide pairing tokens in it. I decided to provide liquidity to 1inch-Dai pool since Dai has a more constant price with only the price of 1inch that may change.

I must say that the eth gas fee can be really killing but I guess the profit would be able to cover if we leave our fund in the pool for long term. There is still a risk in the impermanent loss.

The 1inch-Dai pool has an attractive reward of 415% APY.

Providing liquidity at Cake Defi was a lot easier and straight forward actually.

At 1inch, we need to put our 1inch tokens and Dai tokens into the liquidity pool first to get the 1inch-Dai liquidity pool tokens.

After getting the liquidity pool tokens, I went to farming to deposit my tokens to get the farming started.

415% APY is really attractive and the reward is going to be paid in 1inch tokens.

I probably would not be claiming or withdrawing the reward often as all these actions would need to pay eth gas fee.

The liquidity pool of Cake Defi is definitely really profitable but 1inch has almost double the APY of Cake Defi.

I do not know how reliable 1inch would be as compared to Cake Defi that is officially registered as a company in Singapore.

I do not know how good would my experience in 1inch in the end but it is definitely a calculated risk since I am not putting in a huge investment that I cannot afford to lose.

Let’s see how much I can earn in a couple of months. Hopefully the impermanent loss does not kill my profit.

Click here to visit 1inch if you are interested to find out more about 1inch since we can exchange cryptocurrencies as well as liquidity farming with attractive APY.

https://twitter.com/fun2learn1/status/1344609526071234561

Interesting post. Thank you for sharing your opine. I think many newcomers to cryptocurrency investing will find your option useful.

Thank you

hi @fun2learn - This is was a very interesting and useful post. This type of tech really fascinated me and although I don't have a huge amount to invest, it is definitely worth a try just to see how it all works and hopefully, I will get something back one day. Thanks for sharing.

Happy new year!!

Happy New Year to you too! Hopefully, we get to earn as eth gas fee can be really expensive for most days. There is also the risk of impermanent loss for such liquidity mining but high reward may help to cover this risk as long as the pool does not suddenly close down.

Let's hope so - worth a shot!