Odds Favors Bulls - Trading Journal (2.01.21)

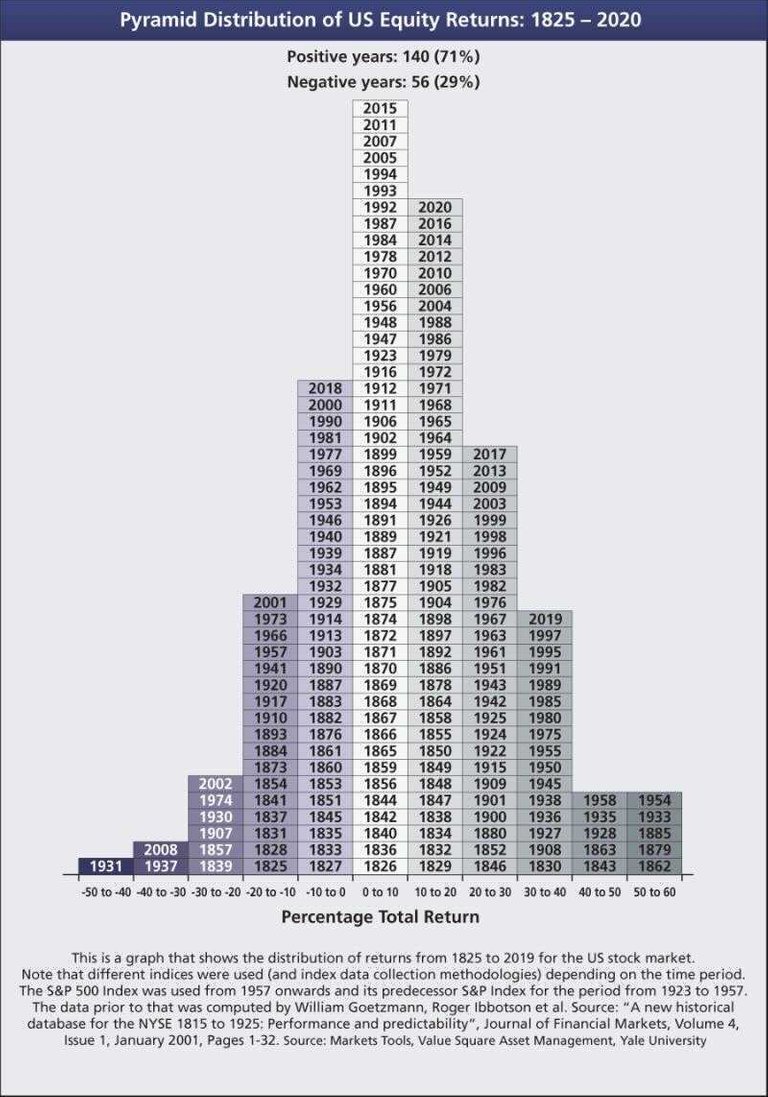

Front page blog post image illustrates the years that markets were green versus red for the year. As the chart shows more years are green rather than red. We are talking about 195 years of the stock market. The comparison is 4 to 1 with green years being in significant lead. Just from this data comparison it should be easy to lean bullish yearly versus bearish as you odds are clearly in bulls favor.

Many Shorting Stocks Can Be Bullish

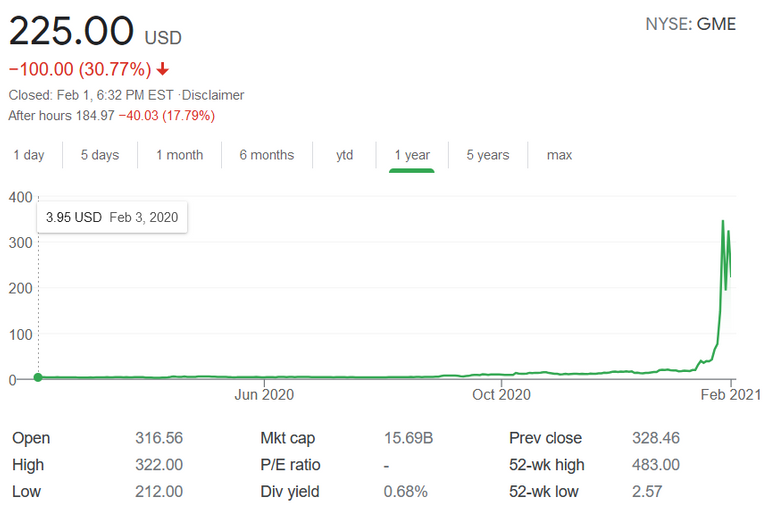

This past couple of weeks have shown that stocks can have short squeeze. Gamestop is the one ticker many retail and institution traders know well.

In situations where stocks are over short and GME as a very good example to observe is that enough people buying will force short sellers to buy back shares at higher prices. The demand becomes larger as short sellers are unable to close out their shares at profitable prices and have to buy shares at a loss.

VIX tends to drop which means Vanna will tend to raise stock prices

We witness this occur right after the elections as the markets exploded to the upside. The situation here is that the uncertainty of who would be president subsided when it was certain that elections were over and a winner would be declared. At the time even though Biden was not yet declare the winner the outcome was certain that the elections was completed with no really crisis in the aftermath. That alleviated the fear of uncertainty forcing stocks to only do one thing, be bought.

When uncertainty looms in markets traders tend to think with their emotions and sell, but this is also the time where fear is over extended. The decade in fear will correspond to the drop in VIX. What is key to note here is that VIX is a measure of insurance premium on S&P index. With a lower VIX it means less premium to pay to anticipate the S&P would drop. Bottom line with less fear there is less likelihood of a further selling in turn more buying.

Often when VIX peaks it is time where selling have been over extended and would likely bounce of a low which means buyers would step in.

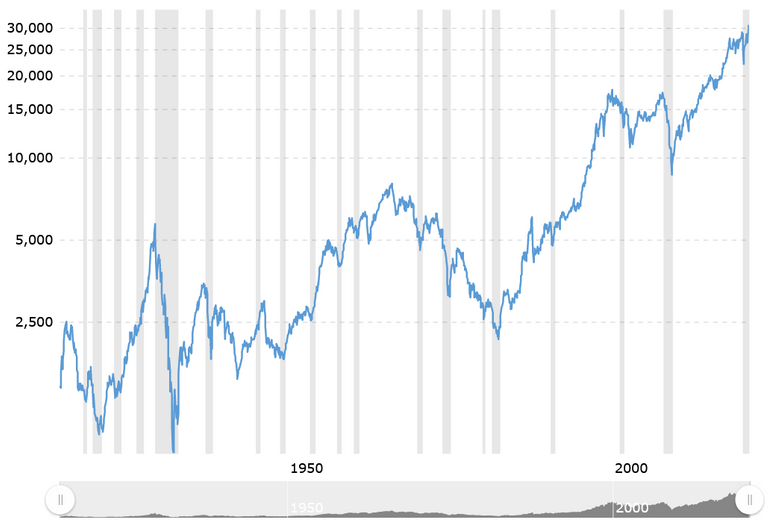

Prices have Historically Trended Upward Over Time

Similar to earlier discussions that most years stocks are green by 4 to 1 but it also means in the long run stocks tend to trend higher. This is partly due to the inherent inflation in the system. Inflation exists as growth in the economy expands. With inflation comes appreciation in asset prices including stocks. As the Dow Jones over 100 years history has shown any draw down is not permanent and that over time prices rise.

None of what I write is financial advice. It is for entertainment purposes only. Thanks for reading!

LeoFinance = Financial Blog

LeoDex = Hive trading exchange for Secondary Tokens, Low 0.25% fees for deposits and withdraws.

HiveStats = Hive stats per user

LeoPedia = Informative content related to anything about Crypto and how to make financial gains in crypto!

Posted Using LeoFinance Beta